|

|

Monday, August 1, 2016

Thursday, July 28, 2016

Wednesday, July 27, 2016

TechCrunch falls victim to OurMine hacking group

Hackers deface technology site while telling visitors attack is only a security test in latest high-profile breach

Other recent victims of OurMine include Twitter chief executive Jack Dorsey, Facebook CEO Mark Zuckerberg and Google boss Sundar Pichai. Photograph: Samuel Gibbs for the Guardian

Verizon-owned prominent technology site TechCrunch has become the latest victim of the OurMine hacking group.

OurMine Security appeared to gain publishing access to the site, which uses the popular content management system Wordpress, and posted its now infamous message.

A post on the site under the byline of Seattle-based writer Devin Coldewey said: “Hello Guys, don’t worry we are just testing techcrunch security, we didn’t change any passwords, please contact us.”

The post was then promoted as a ticker, the top banner in red and a the main story on TechCrunch’s front page.

The OurMine posting appeared at around 12.20pm BST (7.20am ET) but was removed within two hours. It was still showing in Google’s index and cache at the time of writing.

The attack on the technology site is latest in a number of high-profile compromises by OurMine, which included the social media accounts of Twitter chief executive Jack Dorsey, Facebook CEO Mark Zuckerberg and Google bossSundar Pichai.

OurMine also claimed responsibility last week for a DDoS attack on Pokémon Go’s servers.

The TechCrunch attack appears to have leveraged a contributor’s account, rather than a hack on the site’s Wordpress system. In previous attacks, OurMine has used weaker linked accounts to post to services such as Twitter, rather than taking over the user’s social media accounts directly.

The attacks underscore the inherent flaws in linked systems: your accounts, or in this case site, is only as resilient as your weakest link. Security experts recommend the use of two-step verification systems to help prevent accounts being compromised. It is unknown whether TechCrunch writer accounts required two-step verification for access to the site’s Wordpress backend.

TechCrunch, which is owned by AOL, and in turn by Verizon, did not respond to request for comment.

Tuesday, July 26, 2016

The Mall of the Future Will Offer Dinner, Movies, and a Colonoscopy

But not in that order. E-commerce is driving out retailers, and boomers are aging—so here come the doctors.

The Runway at Playa Vista in Los Angeles recently added a Whole Foods, a movie theater, and upscale shops and restaurants—retail center staples intended to attract affluent shoppers, condo-buyers, and tech companies to the mixed-use development. The next big tenant slated to move in, however, is a little different: A 32,000-square-foot doctors' office, where the Cedars-Sinai Health System plans to house outpatient services, including cardiology and orthopedics.

While urgent-care centers have been strip-mall staples for decades, the chance to catch dinner, a movie, and a surgical procedure under the same roof is new—and coming soon to a mall near you. The reason is commerce: Mall operators are looking for tenants that trade in entertainment and services to replace the brick-and-mortar retailers slowly being strangled by Amazon.com and its online competitors. Rents, particularly at older malls, are a bargain.

The health-care industry, meanwhile, is moving away from centralized campuses to bring services closer to patients at a time when two key demographics are entering prime years for consumption. Boomers are hitting an age when they can expect to use more health-care services; millennials are starting families and beginning to make doctors appointments for their kids.

Put those factors together, and voila: You can get your blood pressure checked just steps from the steakhouse.

Chris Isola, vice president in the health-care service group for CBRE, says the idea of putting medical clinics in malls is one that landlords are just starting to come around to. “I think from Cedars’ perspective, that’s how you capture the younger demographic,” he explains. “The challenge is convincing the landlord of a highly desirable center that there should be a medical clinic. It’s like, ‘This is why you should put Cedars here and not break up the space for five or six boutiques.’”

Gauging just how rapidly health-care companies are absorbing retail space is difficult, because the industry is composed of regional and local players, many of which are using only small amounts of space. CoStar, a commercial real estate data and analytics firm, has begun tracking health-care companies as retail tenants only in recent years, making it hard to measure the industry's footprint. But the consensus among observers is that it's the wave of the future.

“It’s a big part of demand growth for retail space,” said Hans Nordby, managing director for Portfolio Strategy at CoStar. “Ten years from now we aren’t going to think anything about it. It will be like, I went to the strip mall, I saw the doctor, and then I bought a pair of shoes.”

Cedars-Sinai isn’t the only health-care provider to take a large space in a retail mall. Others include the Prime Healthcare, which operates a 23,500-square-foot ambulatory care facility at the Plymouth Meeting Mall outside Philadelphia. Last year, UCLA Health put a dozen doctors in a new medical office at the Village at Westfield Topanga, a high-end mall in Woodland Hills, Calif.

Then there's Vanderbilt University Medical Group, which occupies the entire second level at the 100 Oaks Mall in Nashville, Tenn., where patients can pick up a pager when they check in at a clinic, then browse the outlet shops on the lower level while they wait. It used to be that only restaurants would give you a pager to let you know when your table was ready. Now it means the results of your CT scan are in.

As this transformation has begun to take shape, strip malls seem to be more popular than traditional malls because they offer medical tenants an appealing prospect: parking spaces directly in front of their stores so the elderly and infirm don’t need to cover large distances, let alone navigate stairs or escalators.

While outpatient facilities and doctors offices make the move from hospitals and medical suites to the mall, about one-third of the 7,200 urgent-care centers in the U.S. are already there, said Steve Sellars, president of the Urgent Care Association of America. The industry is adding a few hundred new urgent-care centers a year, leading operators to try out new locations. Care Here!, a Brentwood, Tenn.-based health and wellness company, even opened a walk-in clinic in the Nashville airport.

For the health-care companies, softness in the retail market has helped them negotiate favorable leases, including improvement allowances. Medical facilities also look good financially as tenants, with credit profiles that stack up well compared with nail salons and fast-food restaurants.

Still, there's a learning curve on both sides, said Sarah Bader, leader of the global health and wellness practice at the architecture firm Gensler. Many landlords are still coming to grips with the idea that medical clinics won't scare off other businesses. And health-care companies are just learning how to use retail space to build stronger relationships with their customers.

"When you go to Starbucks, you know it’s a Starbucks," she said.

"It's been a challenge, because health-care systems aren't particularly brand-savvy clients." Bader has been working with such companies as Chicago's Northwestern Memorial Hospital to create a design manifesto for its growing retail footprint. "You want people to know that whether they’re having an operation or going to the pediatrician, they’re in the same health system."

Monday, July 25, 2016

t's Official: Roger Ailes Resigns From Fox News

Amid Sexual Harassment Allegations Rupert Murdoch steps in as chairman and acting CEO

By Jason Lynch, Chris Ariens

By Jason Lynch, Chris Ariens

Roger Ailes, who co-founded Fox News in 1996, is leaving the network.

After a flurry of bizarre reports earlier this week, confirmed then quickly denied, about Roger Ailes' exit from Fox News, it's now official: The chairman and CEO is departing the top-ranked cable news network he co-founded in 1996.

Ailes has resigned, effective immediately, 21st Century Fox announced. Rupert Murdoch, executive chairman of 21st Century Fox, will take over as chairman and acting CEO of Fox News and Fox Business Network.

"Roger Ailes has made a remarkable contribution to our company and our country. Roger shared my vision of a great and independent television organization and executed it brilliantly over 20 great years," said Murdoch in a statement. "I am personally committed to ensuring that Fox News remains a distinctive, powerful voice. Our nation needs a robust Fox News to resonate from every corner of the country.

"To ensure continuity of all that is best about Fox News and what it stands for, I will take over as chairman and acting CEO, with the support of our existing management team under Bill Shine, Jay Wallace and Mark Kranz."

The official confirmation of Ailes' departure follows a wild turn of events on Tuesday afternoon, when Drudge Report posted and then deleted the news that Ailes would be leaving the company after receiving a buyout from Fox News of at least $40 million.

At the same time, Matt Drudge also tweeted, then deleted, what seemed to be a separation agreement between Ailes and Fox News, which listed his final day at the company as July 22.

Ailes' exit comes two weeks after he was sued for sexual harassment by former Fox News anchor Gretchen Carlson, whose 11-year employment at the network ended June 23. The lawsuit, filed in the Superior Court of New Jersey in Bergen County on July 6, claimed Ailes called Carlson a "man hater" and "injected sexual and/or sexist comments and innuendo into their conversations."

In letter from Ailes to Murdoch, obtained by the Drudge Report, Ailes said, "With your support, I am proud that we have built Fox News and Fox Business Channels into powerful and lucrative news organizations that inform our audience and reward our shareholders. I take particular pride in the role that I have played advancing the careers of the many women I have promoted to executive and on-air positions."

Ailes added, "Having spent 20 years building this historic business, I will not allow my presence to become a distraction from the work that must be done every day to ensure that Fox News and Fox Business continue to lead our industry. ... I am proud of our accomplishments and look forward to continuing to work with you as an adviser in building 21st Century Fox."

Murdoch held a series of meetings this afternoon with Fox News staffers, to let everyone know that he is now in charge. "He thanked us for all the work we were doing. And he said it's been a difficult 10 days or so, and he said, 'I'm here and I'm in charge,'" Fox News anchor Greta Van Susteren told Adweek and TVNewser not long after the news broke.

Other than Ailes leaving the channel he co-founded nearly 20 years ago, Van Susteren said Murdoch told staffers, "he will be keeping things status quo. There's no change, except that Roger won't be there."

Fox News' chief news anchor Shepard Smith declined to comment about Ailes' departure when approached by Adweek today at the Republican National Convention in Cleveland, shortly after the news broke. Smith would only say, "It's very nice to see you."

While Fox News and Fox Business anchors like Greta Van Susteren, Kimberly Guilfoyle and Maria Bartiromo publicly supported Ailes, other former Fox News staffers anonymously told CNNMoney that they had also been harassed by Ailes but were reluctant to speak out due to nondisparagement clauses.

Meanwhile, the network's star anchor, Megyn Kelly, had remained conspicuously silent about the allegations. Then on Tuesday, New York magazine reported that Kelly told 21st Century Fox's investigators that Ailes made unwanted sexual advances toward her 10 years ago when she was at Fox News.

That news seemed to have been the last straw for News Corp. chief Rupert Murdoch and his sons, 21st Century Fox co-chairman Lachlan Murdoch and CEO James Murdoch. According to the New York report, 21st Century Fox lawyers had given Ailes a deadline of Aug. 1 to either resign or potentially be fired for cause.

Soon after, the news of Ailes' departure briefly appeared on the Drudge Report, setting off a surreal chain of events in which some outlets "confirmed" Ailes' exit while his spokesperson, Irena Briganti (who could also be on the way out, New York reported earlier today), told Adweek and other outlets that the news was "completely wrong." Those "confirmations" were later walked back by the network, as negotiations continued to finalize the terms of Ailes' departure.

Carlson, who joined Fox News in 2005 and was co-anchor of the network's top-rated morning show, Fox & Friends, for more than seven years before she was replaced by Elisabeth Hasselbeck, claimed that things came to a head in September when she met with Ailes, whom she said told her, "I think you and I should have had a sexual relationship a long time ago."

After the suit was filed, Ailes called the allegations "false," "defamatory" and "wholly without merit."

In a lengthy interview with Adweek last November, when he was named Adweek Media Visionary for 2015, Ailes said his relationship with James and Lachlan Murdoch was "very good."

"I don't think they knew, and I don't think I knew, how it was going to work," he said at the time. "It's not contentious in any way."

It remains to be seen who will replace Ailes at Fox News and whether any of his most loyal staffers will follow him out the door. Bill O'Reilly, Sean Hannity and Van Susteren have clauses in their contracts that allow them to leave the network in the event that Ailes leaves, according to the Financial Times.

Shortly before Carlson filed her lawsuit, O'Reilly, who is going to be 67 this year, told Adweek he's not sure how much longer he wants to continue doing his show.

"I don't know," he said. "I go day to day. I don't want to work this hard much longer. I know that."

Ailes will remain as a 21st Century adviser to Murdoch for the time being, as he plans his next move. When asked by Adweek last November what else he hoped to accomplish, Ailes said, "I don't feel any different in my brain than when I was 30 years old. I have the same sort of reaction to new ideas and new things as I did then. I realize I look bad, but I don't feel bad. I'm constantly trying to invent different ways to do things. If you're going to be a television executive, you have to change with the times."

Friday, July 22, 2016

New York’s $8 Billion Airport Still Won’t Get You to L.A.

The cost of LaGuardia’s overhaul doubled, and Delta is stepping up with the cash. What will it get in return?

As with any major revamp of a big airport, the cost of dragging LaGuardia Airport into the modern era is measured in billions of dollars. It started at $3.6 billion, but that was just for a three-story terminal to replace a 1964-era shell that leaks water, squeezes travelers, and inspired U.S. Vice President Joe Biden to dub the runt of New York’s three main airports a “third world” facility.

The refit of the central terminal, also called Terminal B, rose to $4 billion with the later addition of a “Great Hall” entry to connect the 35-gate structure with Terminal C. The entire project also seeks to expand onto real estate now allocated to parking, hard up against the traffic-clogged Grand Central Parkway. The planning and design work alone got $1 billion back in 2004.

Major infrastructure projects in New York City rarely come in under budget or without surprises along the way. The total cost of LaGuardia’s rebirth has been dribbling out slowly, with each increase noted in an obscure press release or at a meeting of the Port Authority of New York & New Jersey. Commissioners even disagree about what to include in the price, and whether past funds should be included to offset it. And there may indeed be some surprises before it’s done. That doesn’t sit well with public interest watchdogs.

“It’s time now for partners to bring greater transparency to the overhaul and build confidence in the project by posting clear budgets and timelines to the project website,” said Joseph Sitt, chairman of New York infrastructure advocacy group Global Gateway Alliance, in an email.

LaGuardia Gateway Partners

LaGuardia Gateway Partners, the winning consortium for the project, took over management and operations at Terminal B last month. The partnership consists of Vancouver-based Vantage Airport Group Ltd., Swedish construction firm Skanska AB, and Paris-based Meridiam SAS. Terminal B, which houses eight carriers, including American Airlines Group Inc., Southwest Airlines Co., and United Continental Holdings Inc., was designed to handle 8 million annual passengers. Last year, it hosted 14.3 million. By 2030, it’s expected to handle 17.5 million per year. The Federal Aviation Administration restricts LaGuardia operations with landing slots due to congestion, as the agency does at John F. Kennedy International and Washington-Reagan National.

All told, the airport’s total projected cost including work at Terminals C and D, redesign of roads, parking structures, and other infrastructure, is likely to run as much as $8 billion.

One of the project’s big funding sources is Delta Air Lines Inc., LaGuardia’s largest operator by passenger share and arguably the most aggressive in terms of trying to become the New York metropolitan area’s “hometown airline.”

“This doesn’t happen without Delta Air Lines,” New York Governor Andrew Cuomo said in a July 2015 speech.

On Thursday, the Port Authority will debate whether to spend $600 million to complement the money Delta will spend to revamp Terminals C and D. The Atlanta-based airline won’t say how much it plans to spend for the new 37-gate dual terminal. The Port Authority’s agenda says “approximately $4 billion for design and construction work,” subject to commissioners approving a new lease with Delta, “as well as other agreements relating to the project.” Under the deal, Delta would pay no rent on the terminal and would get a new lease, through 2050, to match the length of the lease granted LaGuardia Gateway Partners for Terminal B. In 2012, Delta began a more than $100 million improvement project at Terminals C and D, to add larger clubs, new dining options, and a bridge that connects the terminals.

One question that arises is what Delta may want in return for its magnanimity. Aside from its role in the renovation, Delta has also been seeking to have the Port Authority scrap a regulation limiting flights at the airport to 1,500 miles. The “perimeter rule” has been a critical factor in how airlines have structured their schedules at the other two city airports, Newark Liberty International, a United hub, and JFK, the primary home of JetBlue Airways Inc. as well as a Delta stronghold.

“American and Delta would serve the local, New York-to-Los Angeles, and beyond markets from LaGuardia, assuming [they] had the terminal facilities to accompany a high-yield service,” says Robert Mann, an aviation consultant in Long Island and former American executive. “United Airlines is placing its bets on Newark alone.”

In the past, carriers such as American and JetBlue have argued that LaGuardia, in its current state, isn’t prepared for long-haul flights. Sitt, the alliance chairman, said the Port Authority should consider scrapping the rule to boost competition among area airports.

Delta “looks forward to taking the next steps” on its LaGuardia work, a spokeswoman said, declining further comment. A Port Authority spokeswoman referred questions about the project to the agenda for the July 21 meeting, declining further comment.

The full project is expected to finish in 2022. As part of it, LaGuardia may well have a new feature the Port Authority isn’t ready to discuss: nonstop flights to the West Coast.

Thursday, July 21, 2016

AICO Newsletter

|

|||||||||||||||||||||||||||||||

|

Wednesday, July 20, 2016

Is This What You Had in Mind for Retirement?

Here’s What Actual Retirees Found Out

Pre-retirees expect inheritances and income from selling a home to play bigger roles in retirement than they do now, a poll finds.

Retirement can seem like an abstract idea until we're alarmingly close to it. It's a little like dying—inevitable, but who wants to think about it. For that reason, many of us put off important moves that could make old age easier for us and our heirs, such as estate planning and writing living wills.

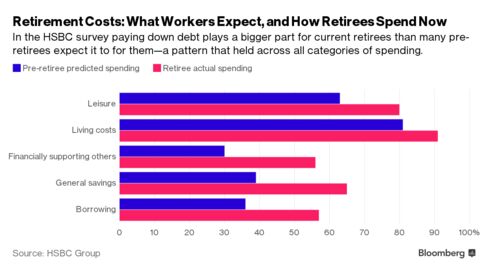

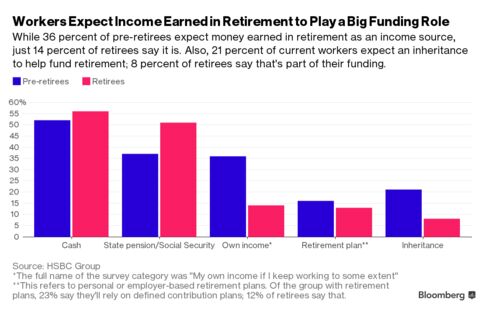

When pre-retirees do contemplate retirement today, a new survey (PDF) by HSBC Group suggests, we're either working off a new model of funding it or we're out of touch with where our money actually goes in retirement, as the chart below shows.

The way retirees today fund their spending differs from what pre-retirees expect for their future, according to results from more than 1,000 Americans surveyed. Their responses were part of a larger effort in which more than 18,000 working and retired people in 17 countries were polled on retirement issues.1

The survey found that Americans, on average, spend five more years in the working world than their global peers, for a total of 35 years. Also, today's pre-retirees expect to save for seven more years than current retirees did. That makes sense since Americans lack much of the mandated level of savings and social services that are the norm in many other developed countries.

Other survey highlights:

- Pre-retirees in the U.S. are more likely than current U.S. retirees to expect future retirement income from selling property, either by downsizing or selling a primary or secondary home—17 percent vs. 10 percent. Among the 17 countries surveyed, that compared with 26 percent for Australian pre-retirees, 9 percent for workers in Mexico, and 4 percent for pre-retirees in Egypt.

- A higher percentage of pre-retirees with children expect to feel happy in retirement than do childless workers—71 percent of working adults with kids, compared with 66 percent of those without children.

- Cash is what 52 percent of retirees are using to fund their retirement, followed by stocks (38 percent), mutual funds (32 percent), and a spouse or partner's income (29 percent). The average across 17 countries is 41 percent, and the U.S. is topped only by Hong Kong, at 62 percent, and Singapore, at 59 percent.

Tuesday, July 19, 2016

The Energy “Death List”:

Who’s On It and Who’s Next? *

In June, Warren Resources filed for Chapter 11 bankruptcy. The Houston-based company was just another one added to the group of 150 North American industry filings over the last year and a half since the oil decline started.

Warren Resources could also be found in the 2015 publication of an “oil company death list” put out by Oxford Club investors’ network out of Baltimore. 19 companies were accused of “toxic” debt-to-equity ratios on the list. Since it was published, eight of the companies on the list have filed for protection, another was purchased at a low price, and few still are trying to keep their head above water.

Out of the eight companies that filed for bankruptcy, seven have headquarters located in Houston: Energy XXI Ltd., Goodrich Petroleum, Halcón Resources, Hercules Offshore, Linn Energy, and Vantage Drilling, and of course, Warren Resources. The remaining company that filed, Magnum Hunter Resources, had relocated to Irving from Houston just before filing.

Both Magnum and Hercules recently surfaced from under the shadow of bankruptcy, but Hercules quickly had to file for Chapter 11 again.

LRR Energy, one of the companies on the death list, was recently purchased by Vanguard Natural Resources, another Houston-based company that was also listed. By the middle of Friday, the firm was trading treacherously low, just under $1.40 per share on the Nasdaq.

Other listed companies trading close to $1 per share include Midland’s Legacy Reserves, EXCO Resources out of Dallas, and the Pennsylvania-based Rex Energy. Houston’s EV Energy Partners, which is handled by EnerVest, is seeing prices barely over $2 per unit. Another company, Exterran Partners out of Houston, was recently renewed into Archrock Partners.

Three out of the four companies left on the death list are still alive:

Houston-based Sanchez Energy Corporation, Tetra Technologies Inc. out of The Woodlands, and Denver’s Antero Resources. The remaining company on the list out of the original 19 is Midland’s Parsley Energy and is said to be “thriving.”

Gone are the days of $100 per barrel oil after mid-2014. In February, prices dropped down to almost $25 per barrel before jumping back to over $45 per barrel on Friday.

Haynes and Boone has followed 157 North American energy firms that have filed for protection since the start of 2015 through June of this year. 82 of them, over half of the original number, are based out of Texas.

Besides the companies on the death list, some of the largest filings include Berry Petroleum, Breitburn Energy Partners, Midstates Petroleum, Paragon Offshore, Quicksilver Resources, Sabine Oil & Gas, Samson Resources, Sandridge Energy, Seventy Seven Energy, Swift Energy, and Ultra Petroleum.

Houston’s C&J Energy Services and Frisco’s Comstock Resources are just some of the companies trading for less than a dollar per share on the stock exchanges.

_______________

* Houston Energy Insider, Article written by HEI contributor Briana Steptoe.

Subscribe to:

Comments (Atom)