Monday, August 31, 2015

Friday, August 28, 2015

For Oil Producers Cash Is King, and That's Why They Just Can't Stop Drilling (BusinessWeek)

Investors sent a surprising message to U.S. shale producers as crude fell almost 20 percent in August: keep calm and drill on.

While most oil stocks have fallen sharply this month, the least affected by the slump share one thing in common: they don’t plan to slow down, even though a glut of supply is forcing prices down. Cimarex Energy Co. jumped more than 8 percent in two days after executives said Aug. 5 that their rig count would more than double next year. Pioneer Natural Resources Co. rallied for three days when it disclosed a similar increase.

Shareholders continue to favor growth over returns, helping explain why companies that form the engine of U.S. oil -- the frackers behind the boom -- aren’t slowing down enough to rebalance the market. U.S. production has remained high, frustrating OPEC’s strategy of maintaining market share and enlarging a glut that has pushed oil below $40 a barrel. West Texas Intermediate crude was trading at $39.08 a barrel, down 23 cents, at 1:03 p.m. New York time Wednesday.

“These companies have always been rewarded for growth,” according to Manuj Nikhanj, head of energy research for ITG Investment Research in Calgary. Now though, “the balance sheets of this sector are so challenged that investors are going to have to look at other factors,” he said.

Output from 58 shale producers rose 19 percent in the past year, according to data compiled by Bloomberg. Despite cutting spending by $21.7 billion, the group pumped 4 percent more in the second quarter than in the last three months of 2014.

That’s buoyed overall U.S. output, which has only drifted lower after peaking at a four-decade high in June. The government estimates production will slide 8 percent from the second quarter of this year to the third quarter of 2016.

The Organization of Petroleum Exporting Countries has been pumping above its target for more than a year. The oversupply may worsen if Iran is allowed to boost exports should it strike a deal with the U.S. and five other world powers to curb the Islamic Republic’s nuclear program.

Frenzied Drilling

Growth has been a key pillar of the revolution that helped transform the U.S. into the world’s largest producer of oil and gas. Frenzied drilling often distinguished the new technology’s winners, while profits or free cash flow were less important.

Even amid the worst price crash in a generation, that continues to be true for some companies. Pioneer is expected to spend$735 million more this year than it generates in cash. Cimarex, which lost almost $1 billion from January to June, has fallen just 6.4 percent so far in 2015 even as U.S. crude declined by more than a quarter.

Executives defend the grow-at-all-costs strategy by saying they’ve changed their methods to be more efficient. Costs for some companies have fallen more than 20 percent, according to Bloomberg Intelligence, and higher productivity has improved the outlook even at $40 oil. Growth is the natural outcome of drilling good wells, according to producers embracing such plans.

“At Cimarex, we’re not shipwreck victims waiting for a rescue ship,” Chief Executive Officer Thomas Jorden said in an investor presentation on Aug. 18. “That ship’s not coming.”

Wait for Rebound

Contrast that with EOG Resources Inc., which has little debt and has allowed its crude output to decline for the first time in eight years.

Chairman and CEO Bill Thomas has repeatedly stressed that returns will be better if the company waits for higher prices, even if the wait is longer than two years. Yet on Aug. 7, when EOG reiterated its plans to choke back the spigot, the stock fell more than 5 percent, the most since January.

For supply and demand to balance for the shale drillers, factors like free cash flow have to start being just as important to shareholders as growth, said Tim Beranek, an energy portfolio manager who helps oversee about $13 billion for Denver-based Cambiar Investors LLC.

“Returning cash to investors has never been rewarded in this space, but that’s going to have to change,” said Beranek, who has made long-term bets on some of the companies, including Cimarex and EOG. “I applaud executives at companies that are choosing not to grow when they know the oil market doesn’t need additional oil.”

Thursday, August 27, 2015

The irony: Ashley Madison plotted hacking rivals to stay ahead of the game

Leaked emails in the Avid Life data breach suggest the site's CEO was more than happy for employees to steal emails from rival companies.

Ashley Madison may have had a taste of its own medicine this month, judging by a cache of leaked emails which suggest the CEO of the site encouraged the hacking of rival firms.

The discreet encounters website, owned by Avid Life Media (ALM), suffered a high-profile data breach in July. A hacking group called Impact Team took responsibility for the cyberattack and has subsequently released large caches of stolen user and corporate data online.

As reported by Motherboard, the latest file dump includes alleged internal emails relating to the CEO of Avid Life Media, Noel Biderman. The emails suggest that after discovering a serious security vulnerability in rival site Nerve, the founding chief technology officer Raja Bhatia was encouraged to exploit the flaw.

In November 2012, a casual message seen by the publication between the executives relates to a "huge security hole" discovered by Bhatia. Nerve.com, once a dating service, captured the interest of Biderman, who asked for additional details.

After exploring further, the CTO found he had access to a massive amount of user data, saying within an email:

"They did a poor job of auditing their site. Have access to all their user records including emails, encrypted password, if they purchased or not, who they talked to, what their search preferences are, last login, fraud risk profile, who they blocked or are blocked from, photo uploads, etc."

In response, Biderman said, "Holy moly..I would take the emails...," however, Bhatia was not interested in infiltrating the site further and stealing content, reportedly saying he "want[ed] to be able to look my son in the eye one day."

While unwilling to do it himself, the executive did demonstrate to Biderman how to exploit the security hole, in addition to a GitHub post containing the allegedly stolen data of a Nerve user. It is unknown whether Nerve.com was informed of the vulnerability.

See also: Ashley Madison hack: A savage wake-up call which is only the beginning

Speaking to the publication, an Avid Life Media representative said the comments were taken out of context, and at "no point was there an effort made to hack, steal or use Nerve.com's proprietary data." Instead, while considering strategic partnerships between Nerve and ALM, Biderman asked for Bhatia's help in "conducting technical due diligence on the opportunity." The spokesman said:

"This activity, while clumsily conducted, uncovered certain technology shortcomings which Noel attempted to understand and confirm."

According to security expert Brian Krebs, a selection of documents now released online by Impact Team include a 100-page movie script written by Biderman and personal data belonging to the CEO such as a scanned copy of his driving license, personal checks, bank account numbers and a home address.

ALM has offered a $500,000 reward for information leading to the arrest of the Impact Team. However, considering the class-action lawsuit already levied against the company and two suicides believed to be related to the data breach so far, it remains to be seen whether anything will be left in the company coffers to offer informants.

Wednesday, August 26, 2015

Noruega sufre por el petróleo barato (Mercado de Dinero, USA)

El desplome del precio del petróleo no solo afecta a los emergentes y a las grandes multinacionales energéticas. Noruega, un Estado cuasi idílico, el más rico y desarrollado del mundo según la ONU y el más democrático según The Intelligence Unit, empieza a sufrir los estragos de un Brent a menos de 50 dólares.

Su modelo económico y social, envidia del mundo y motivo de orgullo de sus ciudadanos, se ha construido durante décadas gracias a la socialización de los beneficios derivados de las reservas petrolíferas que atesora bajo sus aguas.

El brusco descenso en el precio del crudo ha conseguido lo que no pudo hacer la crisis financiera: que la tasa de paro supere el umbral del 4%. Esta cifra, irrisoria para cualquier otro país del mundo, es el nivel más alto en más de una década y se vive como un drama en Noruega. Una oleada de despidos e las empresas que explotan sus vastos recursos energéticos tiene buena parte culpa: con la pública Statoil a la cabeza, estas firmas se han desecho de 20.000 empleados desde que el precio del crudo empezó a flaquear, a mediados de junio de 2014.

Y esto es mucho en una economía en la que más del 10% de los puestos de trabajo dependen directamente del petróleo. El pleno empleo no es el único emblema que empieza a tambalearse, aunque todavía débilmente, en Noruega.

El fondo soberano a través del cual se canalizan los beneficios del crudo ha dado en los últimos días un giro inimaginable hace solo dos años: ante el parón de la economía real, en lo que va de 2015 el Gobierno ha dividido por siete su aportación trimestral este gigante inversor, el mayor fondo de este tipo en el mundo, con cerca de 870.000 millones bajo su gestión e inversiones en empresas, bonos y activos inmobiliarios de todo el planeta.

Para combatir la caída libre en el precio de su mayor fuente de riqueza, que supone aproximadamente el 40% del PIB, el banco central del país escandinavo ha recortado los tipos de interés dos veces en lo que va de año y los analistas creen que tendrá que seguir haciéndolo en los próximos meses.

Tuesday, August 25, 2015

Are Lawyers Getting Dumber? (BusinessWeek)

Yes, says the woman who runs the bar exam

Last August, the tens of thousands of answer sheets from the bar exam started to stream into the National Conference of Bar Examiners. The initial results were so glaringly bad that staffers raced to tell their boss, Erica Moeser. In most states, the exam spans two days: The first is devoted to six hours of writing, and the second day brings six hours of multiple-choice questions. The NCBE, a nonprofit in Madison, Wis., creates and scores the multiple-choice part of the test, administered in every state but Louisiana. Those two days of bubble-filling and essay-scribbling are extremely stressful. For people who just spent three years studying the intricacies of the law, with the expectation that their $120,000 in tuition would translate into a bright white-collar future, failure can wreak emotional carnage. It can cost more than $800 to take the exam, and bombing the first time can mean losing a law firm job.

When he saw the abysmal returns, Mark Albanese, director of testing and research at the NCBE, scrambled to check his staff’s work. Once he and Moeser were confident the test had been fairly scored, they began reporting the numbers to state officials, who released their results to the public over the course of several weeks.

In Idaho, bar pass rates dropped 15 percentage points, from 80 percent to 65 percent. In Delaware, Iowa, Minnesota, Oregon, Tennessee, and Texas, scores dropped 9 percentage points or more. By the time all the states published their numbers, it was clear that the July exam had been a disaster everywhere. Scores on the multiple-choice part of the test registered their largest single-year drop in the four-decade history of the test.

“It was tremendously embarrassing,” says Matt Aksamit, a graduate of Creighton University School of Law, who failed Nebraska’s July bar exam last year. “I think a lot of people can relate to what it’s like to work hard for something and fall short of what you want.” (Aksamit took it again in February and passed.)

Panic swept the bottom half of American law schools, all of which are ranked partly on the basis of their ability to get their graduates into the profession. Moeser sent a letter to law school deans. She outlined future changes to the exam and how to prepare for them. Then she made a hard turn to the July exam. “The group that sat in July 2014 was less able than the group that sat in July 2013,” she wrote. It’s not us, Moeser was essentially saying. It’s you.

“Her response was the height of arrogance,” says Nick Allard, the dean of Brooklyn Law School. “That statement was so demonstrably false, so corrosive.” Allard wrote to Moeser in November, demanding that she apologize to law grads, calling her letter “offensive” and saying that the test and her views on the people who took it were “matters of national concern.” Two weeks later, a group of 79 deans, mostly from bottom-tier schools, sent a letter asking for an investigation to determine “the integrity and fairness of the July 2014 exam.”

Moeser wasn’t swayed. She responded in December, saying she regretted offending people by characterizing the students as “less able”—but maintained that they were relatively bad at taking the exam. In January, Stephen Ferruolo, the dean of the University of San Diego School of Law, asked Moeser to explain how the NCBE scored the test. Moeser rebuffed him, instead inviting Ferruolo to consider the decline in his students’ Law School Admission Test scores in recent years, which, she wrote, “mark the beginning of a slide that has continued.” The implication: Ferruolo and the rest of the people running law schools not named Stanford or Harvard should get used to higher fail rates.

“The response is to stonewall,” Ferruolo says. “Where’s the accountability? I’m not looking to find more information so I can attack the NCBE. I am looking for more information so I can do my job as a dean.”

This year’s results, which will start coming out in September, may be the most critical in the exam’s history. Lawyers and those who hope to join their ranks will soon know if last year was an aberration or a symptom of a worsening problem. Critics of the bar exam say the test is broken, while Moeser maintains the reason so many students are failing is that they are less prepared. “You can squawk loud and long about what’s happening,” Moeser says, “but you’ve got to look at who your student body is.”

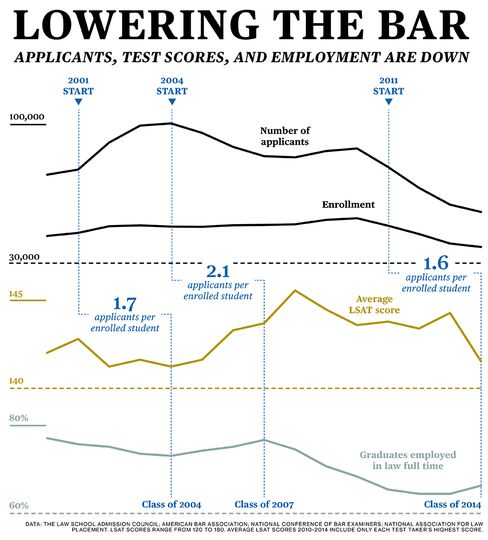

Whether or not the profession is in crisis—a perennial lament—there’s no question that American legal education is in the midst of an unprecedented slump. In 2015 fewer people applied to law school than at any point in the last 30 years. Law schools are seeing enrollments plummet and have tried to keep their campuses alive by admitting students with worse credentials. That may force some law firms and consumers to rely on lawyers of a lower caliber, industry watchers say, but the fight will ultimately be most painful for the middling students, who are promised a shot at a legal career but in reality face long odds of becoming lawyers.

As the controversy raged on into this spring, Moeser’s detractors seized on an irony of her résumé. Wisconsin is the only state that doesn’t require its local graduates to take the bar exam in order to practice law. Moeser never sat for it. “The person who is the czarina, who determines more and more every year what Americans have to learn to pass the bar to become licensed lawyers … never took the bar,” Allard says. “Who is she to say what the standard is? Who is she?”

From a conference room in Madison, Moeser watches a thick layer of smoke on the horizon, traces of a fire raging in Canada. It’s early July, the start of her annual high season, when the NCBE sends the first copies of the bar exam to state officials across the country. After a moment her gaze shifts to her assembled employees, asking them how the day is going. She has more imminent threats to consider.

Moeser is warm and intimidating at the same time, speaking slowly and pausing to stare at the person she’s talking to, like a pitcher guarding against a stolen base. She’s wearing a denim shirt decorated with “NCBE” in gold stitching.After graduating from the University of Wisconsin Law School in 1975, Moeser took a job at the state bar, partly because she had just given birth to her first son, she says, and the organization promised flexibility for its first nonsecretarial female employee.

For 17 years, she administered the Wisconsin bar exam for out-of-state grads. In 1994 she moved to the national level, taking over the NCBE. “It’s an irony that I got to do this and I personally have never taken the bar exam,” Moeser says.

Her eyes shift to the ceiling when considering the hits the test has taken over the past year. Those arguments are like clay pigeons, she says: “You shoot them and they splinter, but the fact is, they are going to get up there and get some attention.”

In a typical year, about 50,000 people take the exam, which is created by a team of academics, judges, and lawyers that the NCBE enlists as volunteers. The organization itself has about 85 employees, including a team of Ph.D.s who spent their time in graduate school on the unenviable mission of studying standardized tests.

Could You Pass the Bar Exam?

Take these sample questions and see how you do.

To keep its public school expenditures under control in a time of increasing costs, a state passed a law providing that children who have not lived in the state for at least one year cannot attend public schools in the state.

Which of the following statements about this law is most accurate as a matter of constitutional law?

Which of the following statements about this law is most accurate as a matter of constitutional law?

- The one-year residence requirement is valid because it does not affect any fundamental right or suspect class.

- State durational residence requirements that are established for publicly funded services are constitutional because they relate to government operations reserved exclusively to the states by the Tenth Amendment.

- Because publicly funded education is a fundamental constitutional right, a state may not deny it to any class of persons who reside in that state.

- State durational residence requirements established for this kind of publicly funded service solely for the purpose of reducing state expenditures violate the equal protection clause of the Fourteenth Amendment.

- PREVIOUS QUESTION

- NEXT QUESTION

Sample questions on the NCBE’s website ask whether a hypothetical lawsuit is destined to fail or why a company’s courtroom strategy is bogus. One particularly intense problem concerns a father who killed his crack-addicted son and whether he should be allowed to argue self-defense in court. State officials score the essays, while the multiple-choice answers are routed back to Madison for Moeser’s organization to grade.

Moeser says underqualified law grads don’t deserve to pass the bar just because they earned a J.D. Her role, she says, is to protect consumers. “Would most people say, ‘Oh, we ought to lower the standards so we can have more pediatricians?’ You’d say, ‘Not with my baby, you can’t,’ ” she says.

The July 2014 exam was controversial even before the results came in. On Tuesday, July 29, after spending the first day of the exam furiously writing, some law graduates who tried to upload their essays were met with error messages. The software that thousands of test takers used for the exam in 43 states had failed. The malfunction was dubbed “barmageddon” and “barghazi” online.

|

| Moeser |

Students spent hours frantically trying to load their essays into the system, and several states had to push back the deadline. Students took to Twitter (after leaving their testing rooms) in all-caps cries for help that ranged from cutesy to apoplectic. ExamSoft, the software maker, ultimately settled with graduates who brought a class action against the company and agreed to pay each member of the class $90. ExamSoft declined to comment for this article.

One of the first steps in evaluating the exam is comparing this year’s results with those of previous aspirants’. The NCBE looks at how the graduates performed on several questions that have appeared on previous exams. If the current test takers did worse, that’s a sign that previous cohorts would have done better on the test overall than the current group. The NCBE converts raw results into scaled scores based on that process.

When the 2014 results came in, pass rates were down across-the-board in states that used the software and those that didn’t. Deborah Merritt, a law professor at Ohio State University, is convinced that the tech problems are partly responsible for the low scores. “You can’t explain that big a gap with the quality of students,” she says.

Merritt says the process punished last year’s test takers. She contends that the glitch skewed the curve, because people in several states may have done worse on certain questions after they spent a night in panic. “If you give one exam where people sit down and another where they stand up for six hours, of course the results will be different,” she says.

Moeser won’t even entertain that analysis, which she calls baseless. “I am not in a position to spend time analyzing results for which I lack respect,” she says. “We’re not in the blogging business.”

Besides, Moeser says, there will always be people who deal with stress better than others. The questions about ExamSoft did pique the interest of her test director, Albanese, who wrote in a June publication of the organization’s magazine that “the glitch cannot be ruled out as a contributing factor.”

“The problem I have is the complete denial on the part of the NCBE that this is a possibility worth considering,” says Jerome Organ, a law professor at the University of St. Thomas at St. Paul (Minn.) who studies bar pass rates. “It’s hard to acknowledge a mistake. It’s really hard to acknowledge one when you’re claiming to be the experts and your credibility and cachet depend on it.”

Since 2008 partner earnings at firms of all sizes have decreased 9 percent in constant dollars, according to federal tax filings. Solo practitioners have been struggling for much longer. Since 1988 earnings for standalone attorneys, of which there are about 354,000 nationally, have declined 31 percent. The legal industry has shed more than 50,000 jobs in the past eight years. The decline began decades ago. Solo practitioners began floundering in the late 1980s. Their average income, adjusted for inflation, was $71,000 in 1988; it was $49,000 in 2012.

Even as business was tanking for a lot of lawyers, American law schools happily welcomed more students. In 1987 there were 175 accredited American law schools. By 2010 there were 200, and after steadily increasing for years, enrollment peaked at 52,000 that year. “There was willful ignorance in what was going on,” says Benjamin Barton, a law professor at the University of Tennessee at Knoxville and author of a recent book on the profession, Glass Half Full.

When Wall Street imploded in 2008, law schools soon took a hit. Hearing that there weren’t enough jobs for all fresh J.D.s, college grads abruptly turned away from the profession. In 2014 enrollments reached their lowest level in four decades. In 2015 fewer people are expected to apply to law school than at any point in the past 15 years. “There was a heyday, and it’s now enduring a correction,” Moeser says. The trouble arises when the people running law schools try to intervene in that correction, she says. “The economics that are driving law schools are scary.”

Big law firms say shrinking law school classes and less qualified graduates haven’t cut into their talent pool. Boutique shops might not be so fortunate, says Tom Henry, the vice chair of Willkie Farr & Gallagher’s Professional Personnel/Legal Recruiting Committee. “It may further constrict those smaller firms’ ability to compete for the same type of business,” he says.

Young people’s aversion to law school is a natural reaction to a saturated job market, says Jim Leipold, the executive director of the National Association for Law Placement, which tracks employment outcomes for recent law grads. “There was definitely an oversupply of law students,” Leipold says.

On the day the first exams are leaving her fiefdom in July, Moeser wants to talk about the LSAT, the law school entrance exam. She pulls out a magazine page. “This is my favorite chart.” One axis shows the change in law students’ LSAT scores at the 25th percentile since 2010, meaning the people who were at the bottom quartile of test takers. Most schools have seen scores at that strata decline. The other axis shows change in enrollment over the same period. Almost every school has lost students, as fewer and fewer young people apply. Some places, Moeser suggests, are dropping their standards dramatically in the interest of stemming that tide. “Feast your eyes on New York,” she says, flipping to a table that has the scatter plot’s data. Her finger lands on Brooklyn Law School, where Allard, her loudest critic, runs the show. In five years the bottom quartile of Allard’s students saw test scores drop 9 points—a steeper decline than at 196 other law schools.

“You’ve got this underclass in law schools who are really keeping the lights on but not reaping the benefit”

In a pinstriped charcoal suit and purple tie, Allard is the most formally dressed person in the classroom. Eighteen Brooklyn Law students are here for a special course to guide them through summer jobs at law offices. One student volunteers that she failed to finish an onerous one-day assignment to summarize a deposition hundreds of pages long. “How did you sleep that night?” Allard asks. Just fine, the student responds, not understanding his implication. “Well, maybe that’s a bad thing,” the dean mutters.

Brooklyn Law opened in 1901 as a night school for working-class strivers, but it’s become a full-time, standalone school and earned a solid reputation. Allard and his allies say the most recent bar exams are stacked against some of their students. “We live in a society where there is an increasing gap between the rich and the poor,” says Ferruolo, the dean at San Diego. “We worsen that by this system that puts more and more emphasis on a testing regime which is biased.” The bias, he suggests, stems from the common practice of bar applicants spending as much as $4,000 on cram courses. Less well-off graduates, already burdened by tuition loans, can’t spend as much time or money preparing for the exam—and end up doing worse.

When fewer people pass the exam, Allard says, poor and working-class Americans suffer in another way: “Most people in America can’t afford lawyers. Most small businesses can’t afford lawyers. The biggest cause of that is that there are too few lawyers being produced.” The bar exam, he says, “perpetuates the status quo in a way that keeps qualified, motivated people from becoming lawyers and deprives most people of affordable legal services.”

Paul Campos, a professor at the University of Colorado Law School and author of the 2012 book Don’t Go to Law School (Unless), cannot suppress a laugh when presented with that logic. “There’s a shortage of lawyers in this country the same way that there’s a shortage of Mercedes-Benzes,” he says. “There are many people who want them who don’t have them.” He predicts that pumping out more J.D.s will only lead to more under- or unemployed attorneys.

That’s part of why Moeser says schools should take their students’ professional prospects into account long before they take the bar. The problem, she insists, isn’t that her test discriminates but that law schools looking to put butts in seats are lowering their standards. In the process, she says, they create false expectations. “You’ve got this underclass in law schools who are really keeping the lights on but not reaping the benefit.” Moeser expects the reckoning to continue. “I would anticipate the scores will drop again, if I had to guess,” she says, her mouth drawing a straight line across her face. “I don’t anticipate a rebound.”

Monday, August 24, 2015

Citigroup’s shocking report: Oil to fall to $20 and end to OPEC?

Oil prices may fall to $20 and the “end” of OPEC may be near, according to a shocking report from Citigroup on Monday.

The move higher in oil since the end of last month was nothing more than short covering and a response to cuts by energy companies, wrote Edward Morse, one of the more influential analysts in the energy space.

“It’s impossible to call a bottom point, which could, as a result of oversupply and the economics of storage, fall well below $40 a barrel for WTI, perhaps as low as the $20 range for a while,” Morse said. “The recent rally in crude prices looks more like a head-fake than a sustainable turning point.”

WTI crude has surged 22 percent to almost $53 a barrel since falling below $44 a barrel on Jan. 29. Prices are still down 46 percent over the last six months.

Citi’s official forecast for when oil will end the second quarter (after that possible drop to $20) is now $35 a barrel, down from a previous forecast of $47 a barrel. WTI will then rebound to end the year at $57 a barrel. It will get back to $66 by the end of 2016, forecasts Morse.

In order to follow Citi’s call, the ProShares UltraShort Crude Oil ETFand the PowerShares Crude Oil Double Short ETN are inversely correlated with the returns for crude.

The call for another extreme drop and then an extreme rebound is similar to what Goldman Sachs told clients at the end of last month when the firm predicted oil would fall to $39 a barrel at some point in the first half of the year and then recover to $65 before the end of the year.

Related: Goldman Sachs sees oil dropping to $30 a barrel

Citigroup calls the development of unconventional oil sources such as shale, oil sands and deepwater drilling “the most disruptive geopolitical factor in markets since the 1970s.”

And despite the best efforts by OPEC and Saudi Arabia not to cut production and accept lower prices in order to pick up market share, the horse is already out of the barn. As soon as the price rebounds, these sources will continue to provide competition to OPEC, which has lost two of its biggest customers, possibly for good, according to Morse.

Saudi Arabia exported 1.6 million barrels a day to the U.S. in 2013, states the report. That fell to to 800,000 barrels this winter. Exports to China are down by half from their peak.

“Markets have, in Citi’s view, correctly depicted the heart of the lower price oil environment as a result of a conflict between markets and marketing influence, or more directly between the impacts of the shale revolution on OPEC’s ability to drive a significant ‘permanent’ wedge well above production costs to maximize revenues for OPEC and other oil-producing countries. No matter what the ultimate outcome, it looks exceedingly unlikely for OPEC to return to its old way of doing business. While many analysts have seen in past market crises ‘the end of OPEC,’ this time around might well be different.”

Thursday, August 20, 2015

Adulterers Take Note: 36 Million AshleyMadison Users Exposed (BusinessWeek)

Hackers claiming to have stolen data from AshleyMadison.com, a website that facilitates hook-ups between would-be adulterers, have released information they say includes details of more than 36 million user accounts.

The data dump appears to be “legit” and includes full names, e-mail addresses, partial credit-card data and dating preferences, according to Robert Graham, chief executive officer of Errata Security, a researcher in Atlanta.

“This is data that can ‘out’ serious users,” Graham said in a blog post. “I have verified multiple users of the site.”

The hackers, calling themselves the “Impact Team,” released a “read-me” file with the data that said they posted the information because AshleyMadison hadn’t been taken down, as they demanded when they said they had obtained the data last month.

“Find someone you know in here? Keep in mind the site is a scam with thousands of fake female profiles,” the read-me note said. “Chances are your man signed up on the world’s biggest affair site, but never had one. He just tried to. If that distinction matters.”

Avid Life Media Inc., the Toronto company that operates the site, said in a statement that it is “monitoring and investigating this situation to determine the validity” of the information and cooperating with investigations by Canadian police and the U.S. Federal Bureau of Investigation.

The company didn’t address the effect the data dump might have on a plan to sell shares this year in London. That listing was proposed after an offering in Canada was shelved due to concerns among potential investors about Avid Life’s business.

Phishing, Spam

The company pledged to do what it can to scrub the data from the Internet, though that may be difficult as download links have proliferated. The information is now available via the BitTorrent file-sharing technology, which means “it’s easily accessible and won’t disappear,” said Wulf Bolte, chief technology officer at German mobile security company mediaTest digital.

A site called AshleyMadisonLeaked.com appears to have the full set of data, including keys to users’ preferences in dozens of fields such as “Bondage,” “Erotic Tickling” or “Experimenting with Sex Toys.”

‘Erotic Tickling’

The site includes e-mail and user-name search boxes that the curious can use to determine whether their information -- or that of someone they suspect of adultery -- was included in the data breach. Apparently many people did exactly that. On Wednesday morning, the “leaked” site was overwhelmed by visitors and difficult to access.

There’s more on the line than people’s relationships. The leak could result in tailor-made phishing, spam attacks or even blackmail, said Mikko Hypponen, an IT security expert with Finland’s F-Secure Oyj.

“The most concrete fear for users listed in the database is that they’re now framed as cheaters, whether they actually did it or not,” Hypponen said. “We have to remember that they are victims of a crime.”

The revelation of the data theft last month cut traffic to the site by half, though it has since partly recovered, according to researcher SimilarWeb. AshleyMadison has seen an average of 2 million visitors daily since July 21, the day after the hack was revealed, down from 2.7 million in the previous three months, SimilarWeb said.

“This hack permanently destroys the perception that AshleyMadison can maintain users’ confidentiality,” said Robert Arandjelovic, a director of Blue Coat Systems, a technology consultancy in Munich. “It’s like doing business with a bank that’s been robbed 25 times in the past year; this has a huge impact on the customer base.”

Wednesday, August 19, 2015

Five more data recovery tools that could save the day

Maybe it was hardware failure or user error or a malicious attack... but you don't necessarily have to kiss that data goodbye. Here are some apps that just might get it back for you.

It's never fun when a hard disk or other data media goes bad. Losing irreplaceable data can really ruin your day. Thankfully, a wide variety of data recovery tools are available that may be able to help you get your stuff back.

Note: This article is also available as an image gallery and a video hosted by TechRepublic columnist Tom Merritt.

1: Data Rescue PC 3

I've used Data Rescue PC 3 (Figure A) on several occasions and had good luck with it. The download consists of a CD/DVD image. The program requires you to burn this image to a blank CD or DVD and then boot the ailing PC from the removable media you've created. This is an important capability, since installing a data recovery utility onto the disk that needs to be recovered risks data loss.

Figure A

Data Rescue PC 3 has all the basics covered, and a Mac version is also available. The software is designed to work even if a drive does not mount properly or if the drive has been corrupted due to hardware errors or viruses. It can recover an entire drive or specific files. If you do decide to perform a full drive recovery, you can opt to perform a block-by-block copy of data from an old drive to a new drive.

Data Rescue PC 3 sells for $99.00, but a free trial is available for download.

2: Bad CD/DVD Recovery

Bad CD/DVD Recovery (Figure B) is a free tool specifically created to recover data from damaged CDs or DVDs. Not only can this tool perform standard data recovery functions, it can also convert a disc's contents into an ISO file.

Figure B

There is even a function for ripping audio files that may exist on a damaged CD.

3: Search and Recover

Search and Recover ( (Figure C) is designed to perform file-level data recovery, although full disk recovery is also possible. The thing that makes Search and Recover unique is its application and device awareness. For example, if you opt to recover pictures and movies, the software asks if you would like to recover data from your camera or from another location, such as your hard disk. The tool contains options for recovering pictures and movies, songs and sounds, emails, and an entire PC.

Figure C

Search and Recover sells for $39.95, but a free trial version is available for download.

4: Boomerang Data Recovery

Boomerang Data Recovery (Figure D) is another nice tool for performing data recovery. It offers two main features worth mentioning. First, it can rebuild a failed RAID array. This can be done manually or automatically.

Figure D

The other nice capability is deep file type awareness. The software knows the difference between various file types and can search for specific types of data during a recovery.

Boomerang Data Recovery sells for $99.95, but a free trial version is available for download.

5: Free Any Data Recovery

Free Any Data Recovery (Figure E) is marketed as a free data recovery tool. In reality, it allows you to recover up to 500 MB of data, but you will have to upgrade to the paid version if you want to recover more data than that.

Figure E

The tool itself uses a relatively simple interface and its best feature is its ability to locate specific types of deleted files, such as MP3 files or Microsoft Word documents.

Monday, August 17, 2015

Now You Can Afford to Fly Like a CEO—to Pittsburgh

An upstart carrier uses business jets to grab nonstop travelers the big airlines cut loose

When U.S. airlines consolidated into giants, they cut down on hubs, reducing the number of nonstop flights from many cities. Since 2008, Delta has ditched Memphis, United has quit Cleveland, and Milwaukee has gotten whacked by the acquisitions of Midwest and AirTran Airways.

Pittsburgh, Indianapolis, Las Vegas, and Nashville all once were hubs. And as American and US Airways look to the completion of their merger over the next year or so, Phoenix's status as a hub has been questioned, given the airline's big operations in Dallas-Fort Worth and Los Angeles. (Executives of American have said they don't plan to shrink Phoenix as a hub.)

Into this void flies an airline called OneJet, using seven-seat business jets to sell flights Monday through Thursday from Indianapolis to Milwaukee, Memphis, and Pittsburgh, with plans to announce Nashville as its newest destination today. It plans to establish a second focus city after Indianapolis next month and is talking with officials in its three destinations about expanding with new flights.

“These cities have lost so much service, and there’s so much demand” from business travelers, Chief Executive Officer Matt Maguire said. “There’s just a lot of low-hanging fruit out there right now.”

Fares are roughly two to three times the cost of advance-purchase economy fares on airlines with connecting routes, he said, though they vary. A OneJet flight from Milwaukee to Indianapolis on Aug. 18 was recently selling for $339.10, or $110.50 more than a United itinerary connecting in Chicago. The company has topped 1,000 passengers after three months of flying and sells its seats through online ticket sites and and corporate travel agencies. Most flights depart in the morning and return in the evening.

“They’re fulfilling a need that the community has, especially the corporate consumer,” said Mark Busalacchi, director of business development for the Indianapolis airport.

Dallas-based OneJet focuses on cities east of the Mississippi that are roughly a one-hour flight apart. It uses a Beechjet Hawker 400XP operated by Pentastar Aviation Charter, a Michigan-based aviation firm owned by Edsel B. Ford II, the Ford Motor founder’s great-grandson.

The Hawker is a private jet with leather seats and ample legroom, but in a cost-conscious business environment OneJet assiduously avoids talk of any overt luxury, focusing entirely on its main attribute of nonstop service. “We did not want this to be seen as a private jet product,” Maguire said, calling the brand “a premium utility” for the business traveler. Even if the nonstop fare is $100 to $500 more than a connecting flight, many employers may not care, figuring that saving their executives time and boosting their productivity are worth it. (OneJet carries almost no leisure traffic.)

OneJet won’t be doing cross-country or major cities such as New York, Chicago, or Boston, both because the economics of longer flights don’t work in its business plan and because the aircraft cabin is too tight for longer hauls. “We won’t do anything over 1,000 miles,” said Maguire, 29, a former sales broker for a regional airline. The company is targeting cities that have about 30 business travelers each way daily. Many of them, such as Memphis and Pittsburgh, once were home to major hubs operated by the network carriers (Delta and US Airways, respectively).

In lieu of secondary cities, airlines have bolstered their positions at fortress hubs, with almost all of their flying now part of the traditional “hub and spoke” networks—an evolution that was predicted, and feared, by airports nationwide. That’s one reason OneJet’s business plan isn’t likely to incur a competitive response from the big players, said Robert W. Mann, an aviation consultant in Port Washington, N.Y., and a former American Airlines executive. “You really won’t see them putting in Indianapolis to Milwaukee, because it’s what they’ve consciously been avoiding doing for the past five years,” he said.

In the mid-1980s, American turned Nashville into a mini-hub and had similar designs on Denver. In Milwaukee, the former AirTran Airways and Frontier Airlines battled fiercely, with both companies expanding heavily in 2010. Republic Airways acquired Milwaukee-based Midwest Airlines in 2009, along with Frontier, part of an ill-fated attempt to expand beyond its regional flying for the network carriers. In 2010, passenger traffic at Milwaukee’s General Mitchell International Airport jumped 24 percent, to 9.8 million from 2009, and then plunged by 37 percent over the following three years amid dramatic cuts by both carriers. Last year, the airport served 6.5 million passengers.

The story is similar at Memphis International Airport, a former Northwest Airlines hub, which has seen Delta slash daily flights from 175 to about 50 over the past three years. In its 2014 fiscal year, Memphis passenger traffic fell 30 percent, to 3.9 million from the year earlier. In 2012, the airport saw nearly 8 million passengers.

“We end up giving more speeches than Billy Graham when it comes to [seeking] air service,” said Will Livsey, senior manager of air service research and development for the Memphis airport. Officials there hope to see a new OneJet nonstop flight to Pittsburgh.

Subscribe to:

Posts (Atom)