Friday, October 30, 2015

Thursday, October 29, 2015

Inside the Secretive Circle That Rules a $14 Trillion Market (BusinessWeek)

- Verdicts affect retirees with investments in bond mutual funds

- Critics say 15-member ISDA committee has conflicts trading CDS

Fifteen of the biggest players in the $14 trillion market for credit insurance are also the referees.

Firms such as JPMorgan Chase & Co. and Goldman Sachs Group Inc. wrote the rules, are the dominant buyers and sellers and, ultimately, help decide winners and losers.

Has a country such as Argentina paid what it owes? Has a company like Caesars Entertainment Corp. kept up with its bills? When the question comes up, the 15 firms meet on a conference call to decide whether a default has triggered a payout of the bond insurance, called a credit-default swap. Investors use CDS to protect themselves from missed debt payments or profit from them.

Once the 15 firms decide that a default has taken place, they effectively determine how much money will change hands.

And now, seven years after the financial crisis first brought CDS to widespread attention, pressure is growing inside and outside what’s called the determinations committee to tackle conflicts of interest, according to interviews with three dozen people with direct knowledge of the panel’s functioning who asked that their names not be used. Scandals that exposed how bank traders rigged key interest rates and fixed currency values have given ammunition to those who say CDS may also be susceptible to collusion or, worse, outright manipulation.

The trade group that oversees the process, the International Swaps & Derivatives Association, is now proposing rule changes that it says will reform the determinations committee. The proposals include limiting the people who can be involved in decision-making and prohibiting panel members from discussing decisions outside meetings, according to a document obtained by Bloomberg News.

For skeptics, the question is whether the changes would go far enough. Because only the biggest CDS traders are seated on the panel, conflicts are not only tolerated but unavoidable.

“You’ve got a self-regulatory body that has handed the authority over an entire market to those folks who have the greatest self-interest and have no prohibition for putting their interests ahead of the broader market,” said Joshua Rosner, managing director of the financial research firm Graham Fisher & Co., who wrote a report on the shortcomings of the determinations committee earlier this year.

Conflicts Mitigated

ISDA says its system is transparent. “Regulators have full transparency on the trades and positions held by all market participants,” according to ISDA spokesman Nick Sawyer. On its website, ISDA says conflicts are mitigated by having both buyers and sellers on the panel.

“I think we have a robust and transparent process,” said Scott O’Malia, ISDA’s chief executive officer. “But like all robust processes, there needs to be continual analysis, feedback and improvement. We will continue to review policies and procedures as market practices adapt.”

Rarely, if ever, does the wider world learn how or why the committee’s decisions are made. Though final tallies and how each firm voted are posted online, discussions among panel members are not.

None of the 15 committee members, nor the firms they represent, would comment for this story. An executive at one of the firms said, without being specific, that there were potentially severe repercussions for discussing the panel’s internal matters.

CDS on corporate and sovereign debt, which are subject to the panel’s decision-making, have bubbled into prominence lately. The plummeting price of oil and other commodities has caused some corporations and governments to struggle to keep current with creditors. For instance, CDS prices are showing that traders have priced in 95 percent odds that Venezuela will default within five years, according to S&P Capital IQ CDS data released Tuesday.

The stakes go far beyond a few hedge funds and banks. Although the market for credit insurance on individual companies and countries has shrunk by 59 percent since 2008, more money is now invested in benchmark CDS indexes than at any time since the committee’s creation in 2009, according to the Depository Trust & Clearing Corp. Mutual funds increasingly use CDS because they’re having trouble finding bonds to trade. That means the determinations committee is increasingly affecting the $3.5 trillion of bond mutual funds, a staple of U.S. retirement savings.

Though the determinations committee has rendered more than 1,000 judgments in the last six years, no records of its discussions have ever been made public -- nor is ISDA proposing they be.

“The problem is there’s no ability for an independent body to determine whether or not the process is fair, which ISDA says it is,” said Dennis Kelleher, CEO of Better Markets Inc., a Washington-based nonprofit watchdog group.

Argentine Debt

How conflicts of interest are handled became apparent last year during a call involving the perilous finances of Argentina.

Had the country defaulted on its debt? The question was submitted to the determinations committee on July 31.

If the panel voted yes, as much as $532 million would flow to CDS buyers. Those buyers included Paul Singer’s hedge fund, Elliott Management Corp. -- also a member of the determinations committee.

Elliott had a history with Argentina. The firm was a creditor during the country’s debt default in the 1990s and had refused to accept a reduced payment for some of its bonds. To get its money back, Elliott’s tactics included trying to seize an Argentine ship docked in Ghana and suing Elon Musk’s Space Exploration Technologies in a bid to take over the rights to two of Argentina’s satellite-launch contracts.

On Aug. 1, the committee voted yes. Argentina had defaulted. According to ISDA, the committee voted the same way it did in almost all its decisions: unanimously.

Only it wasn’t quite that simple.

Elliott’s representative -- Mary Kuan, a partner at New York law firm Kleinberg, Kaplan, Wolff & Cohen -- did something that no member had ever done before, according to people with direct knowledge of the matter. She asked that Elliott be recused from voting.

The rules don’t allow recusals. And if a member firm abstains for any reason twice during its term, it gets booted from the panel.

If everyone with a conflict were recused, there might be no one left to make the decisions, people at the firms said on condition of anonymity. There are conflicts on almost every vote, they said.

Michael O’Looney, an Elliott spokesman, declined to comment on behalf of Kuan and the hedge fund.

Elliott ended up joining the yes vote.

Speedy Solution

Determining whether a company or government has formally defaulted might sound easy, but bonds are often freighted with covenants and structures that are virtually indecipherable to anyone but lawyers and traders.

Before the determinations committee was created, CDS sellers facing payouts on the insurance might insist a “default event” hadn’t been triggered.

After the collapse of Lehman Brothers Holdings Inc. in September 2008 exposed the complexity of the CDS market, Timothy Geithner, then president of the Federal Reserve Bank of New York, decided it needed an overhaul -- and fast. At his bidding, executives of the largest CDS dealers and money management firms met at Goldman Sachs’s headquarters in Lower Manhattan. Working with markers on paper white boards, the group drew up a new system for improving the settlement of CDS obligations.

Their solution: Let us decide.

ISDA, created in 1985, would oversee the determinations committee and everyone would abide by its decisions. If a vote fell short of a required 12-member supermajority, the committee would appoint a three-person external review panel -- something that has happened only twice in six years.

Creating the committee “was part of a series of measures to ensure greater standardization and transparency,” Sawyer, the ISDA spokesman, said. Its decisions can only be based on publicly available information, such as media reports and regulatory filings. The committee is guided by definitions of default “meant to ensure the process is objective and predictable,” Sawyer said.

The executives and regulators who established the determinations committee were less concerned about members’ conflicts of interest than they were in setting up the panel quickly for an avalanche of decisions as the world economy was faltering at the time, according to a person who was there.

“We did consider the issue of conflicts when we designed the process, but the most important thing was to have people with knowledge of the product running the process,” said Athanassios Diplas of Diplas Advisors, who helped create the committee when he was chief risk officer at Deutsche Bank AG’s credit business

.

Unwanted Attention

To some, the process, whatever its shortcomings, is the best approach and helps manage the conflicts that are built into the system.

“By having those invested in the outcomes at the table -- those on both buy and sell sides -- you get the spectrum and difference of opinion needed in complex situations,” said Jordan S. Terry, founder and managing director of Stone Street Advisors in New York. Geithner, through a spokesman at his current employer, Warburg Pincus, declined to comment.

But at least one former panelist said they’ve raised concerns with ISDA about the potential for unwanted attention from regulators, citing parallels with the recent interest-rate and currency scandals.

Sometimes, decisions that are reported on ISDA’s website as unanimous don’t start out that way. Before members vote, an ISDA official often takes an informal poll to see where everyone stands, according to people with direct knowledge of the committee’s deliberations.

The set-up allows members to assess how the panel is leaning, align their interests and thus avoid having the three-person review panel decide, people with knowledge of the matter said.

The Money

The determinations committee also sets the parameters under which CDS holders get paid in the event of a default. It picks which bonds will be included in an auction to set the price of the CDS payout.

Argentina represented a rare case where the public record shows dissent within the committee on that point. In that instance, members disagreed about using yen-denominated bonds that were trading at relatively low prices to help determine the CDS payout -- a step that would effectively require sellers of the insurance to pay more.

The only firm to vote against that plan was Pacific Investment Management Co., according to ISDA’s website. Pimco’s $95.5 billion Total Return Fund had sold CDS to other investors who had bet on a decline in a bond index that included Argentina, according to a regulatory filing. If Argentina’s situation worsened, the index would fall more, meaning Pimco would owe more. Pimco declined to comment.

Representatives of more than half the committee members said the process could be improved, which is what ISDA says it’s now trying to do. Three Wall Street derivatives executives who helped create the determinations committee said a firm should have the option of recusing itself without penalty. ISDA’s proposed new rules don’t address recusals.

Other representatives recommend changing the rules so that the three-person panel makes more decisions.

Rosner would go even further. The best way to fix the process is to ask members to disclose potential conflicts and the rationale for their votes, he says.

“If you want people to feel confident in the fact that the committee works for the best interests of the market then you have to have that transparency,” he said.

Wednesday, October 28, 2015

Alertas de Fraude (Comisión Federal de Comercio)

|

Monday, October 26, 2015

When Facebook Knows You Better Than You Know Yourself...

Every time you log in to Facebook, every time you click on your News Feed, every time you Like a photo, every time you send anything via Messenger, you add another data point to the galaxy they already have regarding you and your behavior. That, in turn, is a tiny, insignificant dot within their vast universe of information about their billion-plus users.

It is probable that Facebook boasts the broadest, deepest, and most comprehensive dataset of human information, interests, and activity ever collected. (Only the NSA knows for sure.) Google probably has more raw data, between Android and searches–but the data they collect is (mostly) much less personal. Of all the Stacks, I think it’s fair to say, Facebook almost certainly knows you best.

They can use this data for advertising, which is contentious, I suppose; but much worse, it’s boring. What’s long been more interesting to me is the possibility of interpolating from this data, i.e. deducing from your online behavior things that you never explicitly revealed to Facebook–and extrapolating from it, i.e. predicting your reactions to new information and new situations. What’s interesting is the notion that Facebook might be able to paint an extraordinarily accurate pointillist picture of you, with all the data points you give it as the pixels.

That’s pretty abstract. Let’s try a couple of concrete examples. Imagine that Facebook could figure out with a high degree of confidence, from the way you use its app and site, from the links and photos you post, the apps you use, and the stuff you Like, whether you’re a hard worker or a shirker, and whether you’re a good or bad credit/insurance risk. Interesting stuff, to a would-be employer and/or a would-be insurer, no?

And not near as futuristic as it may sound. Your phone can tell whether you’re depressed. Algorithms are already being used to judge our character, and can determine whether your relationship is in trouble based on your collective social graph.

And Facebook just keeps expanding its remit of data. As of this week, you can search all of its trillions of posts — meaning that it can and will add more and more search data to what it knows.

One wonders whether, and how much, it will actually use this data, though. After all, if and when people discover that they inadvertently reveal things they may wish to keep private by simply being themselves on Facebook … they may well decide to stop being themselves on Facebook. Which will mean less candor, less sharing, more forethought and judiciousness — and less time spent on Facebook.

On the other hand, instead of making it clear what they know about us all, they may well simply use this information in an opaque way, to continue increasing their reach and their profits:

…in which case Facebook will become a kind of one-way mirror, one that may ultimately literally know you better than you know yourself. Which in turn raises fascinating and disturbing ethical questions worth of a Philip K. Dick (or Kafka) novel — what if Facebook’s deep neural networks predict, based on your behavior, that you’re going to commit suicide? What if they predict that you’re going to kill someone else? What if they have 90% confidence? What if they’re wrong?

I don’t pretend to have the answers. But I think it’s worth considering the possibility that human data on this scale will in the not-too-distant future act as both an X-ray, revealing things about ourselves that we had thought secret, and a searchlight, illuminating what we’re likely to do next.

Friday, October 23, 2015

Could 'Bridge of Spies' Be Steven Spielberg's Last DreamWorks Movie? (BusinessWeek)

This weekend marks director Steven Spielberg’s first film in three years and potentially the last under the DreamWorks banner he founded more than 20 years ago.

“Bridge of Spies,” a Cold War thriller starring Tom Hanks, opens in theaters in the U.S. and Canada this weekend, with critics applauding the picture and deeming it Oscar-worthy. It’s co-produced with Participant Media, a maker of socially conscious films that looks set to play a crucial supporting role in Spielberg’s future moviemaking.

While Spielberg has had unmatched box-office success, the DreamWorks studio he co-founded in 1994 has had to raise money several times. Now, the director is seeking hundreds of millions of dollars more to keep making the kinds of movies he wants, people with knowledge of the matter said. He’s looking to team up with Jeff Skoll, who was the first employee at EBay Inc. and went on to found Participant, said the people, who asked not to be identified discussing private matters. The two worked together on the Oscar-nominated civil-rights dramas “The Help” and “Lincoln,” as well as “Bridge of Spies.”

“He wants and needs a large amount of autonomy within the system, and somehow or other always gets it,” said Joseph McBride, author of “Steven Spielberg: A Biography,” in an interview. “Even if it’s a challenge sometimes.”

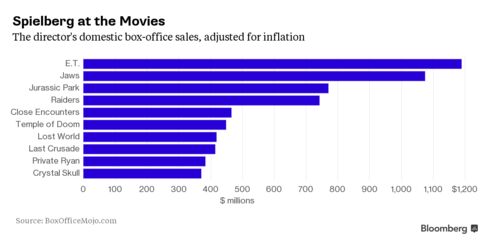

Where Spielberg lands matters. He’s the top-grossing director of all time, with domestic ticket revenue of $4.19 billion from film credits that include “E.T.: The Extra-Terrestrial” and “Raiders of the Lost Ark,” according to researcher Box Office Mojo. He’s received more than a dozen best-director and best-picture nominations, including winners like “Schindler’s List” and “Saving Private Ryan.”

Participant, which specializes in topical or controversial message films, is in talks to provide about half of the estimated $400 million that Spielberg is looking to raise, the people said. A deal could involve Skoll’s company investing in DreamWorks or both merging into a new company, one of the people said. Under one possible plan, DreamWorks could be replaced by a new company, Skoll told the New York Times in September.

As part of those negotiations, the distribution and marketing of DreamWorks movies may move from Walt Disney Co. to Comcast Corp.’s Universal Pictures, which originally backed the young Spielberg decades ago when he made the blockbuster “Jaws” and “E.T.” and where he still keeps his office.

Participant Media has co-produced seven films with DreamWorks. Their record of collaboration suggests they’d continue to make films that are topical and historical, frequently acclaimed by critics, and often in the hunt for Academy Awards.

“Bridge of Spies” is inspired by real-life events, and was written by Matt Charman and Oscar winners Joel Coen and Ethan Coen. Hanks stars as a lawyer recruited by the CIA to negotiate a Cold War prisoner exchange with the Soviet Union: downed American pilot Francis Gary Powers for KGB intelligence officer Rudolf Abel, who was arrested for espionage in the U.S. The events have spawned several books, including a historical account of the same name by Giles Whittell.

The film cost about $40 million to produce, according to Box Office Mojo, as well as millions to market. BoxOffice.com estimates “Bridge of Spies” will produce $17.5 million in weekend ticket sales in the U.S. and $64 million through its entire domestic theatrical run. Oscar buzz could extend that run and help the film in overseas markets.

The film took in $500,000 in cinemas Thursday night, according to Disney, its distributor. That compares with $600,000 in first-night sales for “Captain Phillips,” the 2013 Oscar-nominated film featuring Hanks as a real-life captain of a cargo ship that’s hijacked, according to the studio.

“Bridge of Spies” is expected to open in third place behind “Goosebumps,” based on the R.L. Stine children’s books, and the returning Matt Damon film, “The Martian.”

Over the near term, both Participant, based in Beverly Hills, California, and Spielberg have busy schedules. In 2016, Participant is releasing seven films, including “Deepwater Horizon,” a film about the 2010 Gulf of Mexico oil spill, with Lions Gate Entertainment Corp.

Spielberg, 68, is already at work producing another “Jurassic Park” film after the success of this year’s “Jurassic World,” which he made for Universal, and has suggested there may be a fifth “Indiana Jones” movie, this time with Disney.

He directed “The BFG,” a family film based on the work of Roald Dahl, which comes out in July, and is set to direct the video-game sci-fi “Ready Player One” for Warner Bros. for release in 2017.

“Spielberg does whatever he wants to do, he makes the films he wants to make,” said Jonathan Kuntz, a film historian who teaches at the University of California, Los Angeles. “He can really choose the properties, whatever he darn well pleases, no matter who he is working for. ”

Thursday, October 22, 2015

How The Apprentice Explains Donald Trump's Campaign (BusinessWeek)

His base is Apprentice viewers; and his Iowa coordinator is an Apprentice finalist who chooses delegates using Apprentice-style games.

“Strategy is everything,” Tana Goertz, the woman in charge of the contest, tells her 22 contestants. “We’re going to start big with your task. You have 15 minutes. GO!”

The tableau is so familiar that it’s easy to forget why people are gathering here in the parking lot of a mall in West Des Moines, dashing inside to collect signatures from as many strangers as possible. The prize is an invitation to stay in the game until the next round and a photo op with the big shot they all want to work for. Nobody’s filming the action and, strictly speaking, this isn’t reality TV but a presidential campaign. Except that the candidate is Donald Trump—so it’s both. Those signatures? They don’t have a purpose other than to bolster a campaign database. And that slot the contestants are battling for? A position as one of the delegates who will get to carry the Trump banner in Iowa’s caucuses in February.

That Trump’s campaign is finding its Iowa delegates via staged, game-show-style events might seem odd. But it begins to make sense when you consider the extent to which Trump’s appeal as a candidate is built on his starring role on The Apprentice—a prime-time network show that, it must be noted, has aired for 14 seasons with anywhere from about 5 million to 20 million viewers. Although he’s no longer the host of the program (that honor now belongs to Arnold Schwarzenegger), The Apprentice continues to function as a piece of heavy and essential campaign machinery, arguably providing Trump’s most important edge. Other campaigns struggle with the painstaking and expensive organizational hurdles of identifying potential voters by shared values, building name recognition through ads and public appearances (and, if they’re lucky, press attention), working to alchemically combine message and personality to attract a fickle constituency who just might leave if the candidate says the wrong thing. Meanwhile, The Apprentice’s viewership gave Trump a giant base of committed, non-ideological enthusiasts.

“I’m the only one that’s peed in his blue onyx toilet.”

And consider that the idea of procuring caucus delegates through Apprentice-like competitive “tasks” came from Goertz, 48, the Trump campaign’s Iowa co-chair and a woman who rarely fails to cite having been a contestant on The Apprentice as the defining experience of her professional life. In 2005 (Season 3 to the faithful) she lasted until the penultimate episode and was named runner-up. That year, the show pitted a team whose members had college degrees against people who didn’t, the battle of school smarts vs. street smarts. Goertz, a pillar of the self-made squad—she’d spent 10 years going door to door in Iowa as a Mary Kay saleswoman—returned from her near-win to cobble together a living doing gigs in entrepreneurial self-branding. “I do motivational speaking, life coaching, product endorsements,” she says. “The best part of my career? I’ve never had a boss. I learned that from Trump.”

She was paid to address an audience of 5,000 for a convention of the Atlanta Chamber of Commerce. She had a short-term deal as spokeswoman, with her picture on the packaging, for the BeDazzler—a home-crafts tool for affixing rhinestones. And a minor league hockey team in Des Moines hired her “to put asses in seats,” which she accomplished through a series of contest-like promotions. “People come to me to put their business on steroids, to give them what made me successful, which is the TV show and using the competition style,” she says. “It brings out superstars. It attracts people who are driven and want to kick ass.”

Goertz, a mother of two, is that person. She has sculpted features, an aerobicized physique, and a vocal delivery that sounds as if it were created in a laboratory specifically for infomercials. When she calls supporters on the phone, they tend to mistake her for a recorded announcement that they’ve won something.

Winning!

At the Jordan Creek mall, Gina McClelland, a freckled, middle-aged woman in jeans and running shoes, is declared the winner for having obtained seven names (and, probably more important—the rules were a bit vague—for being the first to make it back outside to the Trump bus that serves as home base). Goertz stands on a Pelican cooler to address the crowd of about 40 volunteers and contestants.

“I heard a lot of you say you didn’t have a watch, but as an apprentice, you have to take that into account,” she says, before heaping congratulations on McClelland. “This is a woman who wasn’t going to come to this event because she didn’t believe in herself, because she didn’t think her job was glamorous enough.”

“I didn’t feel like one of the pretty people,” McClelland says. “I’m just a fat old truck driver, but I feel like Cinderella at the ball.” She beams and does a little shimmy with her hips, adding that as a trucker, “I’m not used to sprinting.” She learned about the event on Goertz’s Facebook page—the two hadn’t met—but when she wrote to express reluctance, “Tana told me, ‘Mr. Trump is who you want there for you. We’re all insiders now, and we’ll see each other again.’ ”

“When I heard you say that, I was about to go to my Tana Therapy place,” Goertz says. “You are beautiful, Gina.” She asks one of Trump’s Iowa advisers to retrieve a T-shirt from the bus.

“I will knock on a thousand doors,” McClelland says, adding that her strategy for obtaining signatures was simple: She only went to Scheels sporting goods. “They sell guns.”

In light of Trump’s candidacy, The Apprentice—and The Celebrity Apprentice, its later iteration starring famous contestants—can be viewed as an extensive Trump campaign ad, or as Goertz might say, an infomercial on steroids. Polls suggest that Apprentice viewers are Trump’s base. David Axelrod wrote on CNN’s website that Trump’s poll numbers just after the second Republican debate were almost twice as high among people who watched the show than those who didn’t. Among those who didn’t, he still led the pack, though by only a single percentage point.

NBC introduced The Apprentice in early 2004, touting the premise as “the ultimate job interview” and offering 16 young and mostly unpolished men and women the chance to land a $250,000 job “running” a Trump building in Chicago. The candidates were split into two single-sex teams and all shared a giant apartment in New York’s Trump Tower. The weekly-elimination format had them competing at selling lemonade on sidewalks, constructing ad campaigns for a private jet company, and finding somebody to rent a Trump penthouse for no less than $20,000 a night (Trump’s properties and corporate sponsors were heavily featured). Instead of employment with Trump, winners on the Celebrity Apprentice score donations to favorite charities. In July, NBC severed ties to Trump shortly after he announced he’d be running for president and disparaged Mexican immigrants to the U.S.

Goertz prepares for a Trump rally in Waterloo, Iowa, on October 7, 2015.

As one of Trump’s three co-chairs in Iowa—a fundraising position on most campaigns—Goertz has the central function of connecting Trump, the Apprentice character, to voters. “Who he is came through on the show: a boss. And through me, that’s how people in Iowa will see him,” she says.

Upon hiring her, Chuck Laudner, Trump’s Iowa campaign director, said, “Tana, you’re the only one who actually knows him,” Goertz recalls.

“That’s true,” she adds. “I can put the human qualities to the star. I’m the only one who has sat next to his wife at dinner. I’m the only one that’s peed in his blue onyx toilet.”

Most of the people who arrive at the Sept. 7 event in West Des Moines are Apprentice fans, and lots of them know Goertz from her appearance on the show as well. There are jokes about firing Obama and several people who say they haven’t voted in decades but are going to vote for Trump in February.

A post-speech meet and greet with the candidate.

“Something he was saying just resonated,” McClelland says. “The GOP establishment is really not speaking to me. I wasn’t going to even caucus this time, until Trump came along. I probably would’ve voted libertarian. I’m not voting for a Bush again, and I wasn’t going to vote for Hillary. I’d vote for Bill.” She adds, “I liked the season with Bret Michaels.”

Mary Lynn, who began corresponding with Goertz on Facebook after she lost her 35-year-old daughter to cancer in 2013, had admired her on the show almost a decade earlier. Trump was already making himself into her favorite candidate, she says, playing his part reliably. “I’ve had some issues with medical services available and what’s available to people who aren’t legal—seeing illegals coming into the hospital with purses from Dooney & Bourke, while we’re just trying to feed the grandkids,” she says. “And that’s why I like him.” She points to the Trump bus. “He just says it like it is. He’s the only person who doesn’t try to convince me of both sides.”

Audiences, both live and on television, respond to Trump’s aggression, says Richard Thornton, one of Goertz’s co-chairs for the Trump operation in Iowa. “I love to watch the look on their faces. Sometimes he’s a little strong, and he may step over the line. But he doesn’t double dribble. He just shoots away.”

Audience members wait for Trump to take the stage.

To watch old Apprentice episodes is to understand that what Trump-leaning voters find appealing—along with his undisguised contempt for “illegals,” opponents with homely faces, and world leaders whose identities can be grouped under the umbrella “Arab name, Arab name, Arab name”—is the C-suite bully. Yes, for some viewers, there’s a kind of glee in Trump’s lack of self-awareness, blowing his own horn—claiming (in the second debate) that “the hedge fund guys … all love me,” or (to contestants on The Apprentice) that he inhabits “the nicest apartment in New York,” a place usually only visited by “presidents and kings.” But the money shot of each episode arrives when he fires another unsophisticated, desperate, or merely hopeful contestant.

Trump is a boss who takes delight in canning people. He calls them by turns “stupid,” “losers,” “absolutely terrible,” and “a very, very ineffective leader.” A group of aspirants earns a special distinction: “In this boardroom, we’ve never had a team lose so badly.” Then, in a tuxedo, he tells them, “Go home. Go home,” as an overhead shot depicts several humiliated men in Florsheims wheeling their carry-on luggage through the Trump Tower lobby. Trump’s capricious lowering of the boom brings to mind Joe Pesci toying with the uninitiated in the early nightclub scene in Goodfellas. When a woman tries to speak up for a man who’s about to get fired, Trump asks her, “What are you doing to yourself? How stupid is that?” Then he fires her instead, apparently for being too nice. Trump abruptly fires another man simply for the humble revelation that he comes from a “white-trash background.”

“You think I want to hire somebody that’s white trash?” Trump asks rhetorically. “How stupid can you be?”

For others, it’s presumably a different side of Trump that renders the show satisfying: the mentor presiding over his meritocratic tournament of Big Business, doling out wisdom between the firings and insult-comedy shtick. The weeding-out games tend to be pure sales competitions. Unlike in talent pageants or food or fashion reality shows, winners and losers are determined strictly by the numbers.

On occasion, Trump relishes the opportunity to be generous. There was the time he dismissed a contestant who had designed (and modeled) the most egregiously skimpy, pink swimsuit. Trump permitted him to keep the trunks as his parting gift. Trump preaches a work ethic of diligence and optimism. “Do what you love, and you’ll be successful,” he often says. On The Celebrity Apprentice, he made a point of donating his own money to losing contestants’ favorite charities simply because they asked or because he felt they deserved to have fared better. Recently, when Fortune surveyed most of the winners from the original, pre-celebrity series, they praised his loyalty, attention to detail, and willingness to share practical advice once they came to work for him. One described Trump as “a guy who held up his end of the bargain,” adding, “he truly took me under his wing.”

One morning in September finds Goertz handling phone calls at her kitchen table. “We haven’t moved into our office yet—this week,” she says. Her husband, a local TV weather forecaster, is asleep; he’s on air during the lobster shift. In their driveway is her Hummer H3 with vanity plates that read, “HEY TANA.” She has a small study in a corner of her basement stocked with hundreds of purses and 500 self-help books, including Nice Girls Don’t Get Rich, some Dale Carnegie, and Trump’s No Such Thing as Over-Exposure.

Although she’s yet to meet one of her two fellow campaign co-chairs in Iowa—a former military man in Sioux City—she’s in steady contact with the other, Thornton. A well-connected lobbyist in Des Moines who shows up in her phone as “Buddah” when he calls (a typo—she means the deity), he keeps asking her to fix him up with her girlfriends. Thornton says Goertz’s ability to warm up a crowd before she introduces Trump is “the kind of thing that makes you want to have a blood transfusion from her.” A lot of folks call Goertz requesting her help in getting Trump to show up to promote their events. “You want me to use my Trump card,” is her way of conveying the audacity of the ask.

She returns messages from strangers in other states who’ve seen her on TV and would like to volunteer. Most are retired, and talk about the country “heading in the wrong direction” or needing to get “back on track.” One man, a former contractor in Indiana, wants to handicap the race. He asks about the threats posed by Vice President Joe Biden and “the socialist.” “Do we need to be concerned about the surgeon?” he asks.

“No, no, we don’t,” Goertz says. “He doesn’t have the business experience.” She adds that he’s low-energy. “I’m excited,” she says to the caller before hanging up. “I’m working for the next president of the United States.”

CNN calls asking if she’ll appear later in the day to be interviewed as a Trump spokeswoman. She has her Des Moines-based business manager call back to explain that “I can’t do immigration or anything regarding the debates.”

Iowa first, then the world

Goertz has found 20 delegates using Apprentice-inspired tasks. One is her son, Myles, a senior at the University of Iowa. “He won a social media campaign I came up with to get likes for Trump,” she says. “He got hundreds, maybe—it’s a very liberal school—to be named the campus caucus leader. Basically, he beat, like, his eight friends, who I was pushing to do it. But he met Mr. Trump in Dubuque, and he was thrilled. Trump says he’s going to go far.”

Iowa is currently the only state in which the campaign builds support through contests, but Goertz says she plans to replicate the practice elsewhere when she hits the road with the Trump team. “Trump personally told me he’s taking me with him,” she says.

Working for Trump poses unique challenges for the advance staff. “People show up automatically with Trump, especially the press,” she says. “When he’s thinking of coming to Iowa, we actually have to keep it quiet so that local security isn’t overtaxed.”

HeTrump’s national political director, Michael Glassner, called to tell her, “Good job, kid.”

On the June day when Trump announced his candidacy, Goertz called his office in New York and offered to help in Iowa. “I spoke to Rona, his secretary—we’ve talked for 10 years,” she says. “I just always figured having Trump close to me was a win.” Within the week, she was having a three-hour interview at a Des Moines coffee shop with Laudner, who she says told her he was a fan of The Apprentice and offered her a paid position as they stood to say goodbye. At first, she thought that, in a Trump administration, she’d be well-suited to an ambassadorship (“the Bahamas or Bermuda”) but has since come to feel that a White House job “would make me seen and known better here in America.”

Goertz says she was the first of her ex-Apprentice cohort to so much as volunteer for the campaign. “Now, they’re all asking me for jobs,” she says. “Guess what I tell them? ‘Ask Trump yourself.’ ”r other duties include hiring the Trump bus and getting “a wrap for it and a driver,” she says. “And I have to find the place where supporters can come watch the debates on TV.” Goertz adds: “I got a Sprint car driver to wrap the wing of a car with a Trump sign. And when the car died in the practice lap”—it needed a new engine—“I found another driver to drive with the Trump wing in half an hour.”

Tuesday, October 20, 2015

América Latina podría caer en recesión en 2015...

El 2015 ha sido un año de dificultades económicas para América Latina y el Caribe. Incluso, según el Fondo Monetario Internacional en su informe de octubre, para el cierre de este año, la actividad económica de la región retrocederá 0.3% y apenas crecerá en 2016.

La Comisión Económica para América Latina y el Caribe (CEPAL) coincide con estas estimaciones, y redujo su perspectiva a -0.3%, mientras que el Banco Mundial es un poco más optimista, y pronostica que la región simplemente no crecerá este año.

Pero el problema se acentúa cuando se analizan los indicadores para 2016, los cuales estiman que la contracción económica podría agravarse el año que viene.

El riesgo de recesión es más probable en países como Brasil, Colombia, Chile, México y Perú, debido a que son las economías más abiertas de la región.

La situación económica en América Latina es bastante común entre sus miembros, pero circunstancias especialmente difíciles en dos de sus economías más importantes –Brasil y Venezuela- inciden negativamente en el promedio regional.

Pero, ¿cuáles son los factores que influyen en este desempeño negativo en Latinoamérica?

1.Desaceleración de la economía de China

Ya China no crece a un 10% anual como nos tenía acostumbrados. 2015 ha sido un año de desaceleración interna, problemas en sus exportaciones y caída en los precios de las materias primas.

En julio, las exportaciones del gigante asiático cayeron 8%, su mayor descenso en cuatro meses y además se ha evidenciado una contracción en su actividad manufacturera.

Tomando en cuenta estos factores, el FMI estima que la economía China crecerá sólo 6.8% en 2015.

El organismo internacional ha solicitado a este país que aplique reformas para garantizar un crecimiento sostenible sobre todo en materia cambiaria. Un tipo de cambio de libre flotación mejoraría la autonomía de la política monetaria y ayudaría a la economía a ajustarse a los choques externos, según el Fondo.

La situación en China ha depreciado los tipos de cambio de Latinoamérica, por lo cual los países que no tienen sus economías dolarizadas como México, Brasil y Chile resentirán aún más este impacto.

2.Desplome de las materias primas

La caída en los precios de las materias primas se ha convertido en un problema serio para la mayoría de las economías de la región, principalmente exportadoras de estos bienes. Se le suma además, que este factor ha creado volatilidad en sus mercados financieros.

El Fondo Monetario Internacional estima que este declive en los precios se mantendrá en 2016 y afectará, sobre todo, a ocho países de la región, debido a que dependen económicamente de la exportación de estos productos: Venezuela, Ecuador, Colombia, Bolivia, Argentina, Perú, Chile y Brasil.

3.Volatilidad debido a la demora de la Fed

A causa de que la Reserva Federal de Estados Unidos (Fed) no ha decidido aumentar las tasas de interés en ese país, medida que busca fortalecer aún más el crecimiento estadounidense, los mercados y las tasas de cambio se encuentran aún en un estado de alta volatilidad, generando inestabilidad en las economías emergentes como las de América Latina.

4.Precios del petróleo en declive

Los tres organismos financieros aseguran que la caída en los precios del petróleo han afectado directamente a países como Venezuela, México, Brasil, Ecuador y Colombia.

Este efecto será mucho más negativo para Venezuela debido a que el crudo representa 90% de sus exportaciones y más de la mitad de sus ingresos fiscales. Este es un factor que agrava la situación del gobierno del presidente Nicolás Maduro debido a que ha generado una crisis económica importante.

Aunque Brasil no depende de sus exportaciones petroleras debido a que su consumo es interno, el problema que enfrentará este país es que se reducirá el interés de los inversionistas en continuar con los procesos de exploración y explotación de los yacimientos en aguas profundas.

Chile y Bolivia se ven beneficiados con los bajos precios del petróleo debido a que son importadores del producto.

5.- Estancamiento de la economía europea

Friday, October 16, 2015

City of Miami: Liberty City Trust

Join

Liberty City Trust's first time Homebuyers Club

Learn about closing

cost, your rights as a consumer

and much more.

|

|

Program

Details

|

|

First

time Homebuyers Club offers information about:

|

|

Important

Information

|

|

|

When

October 20, 2015

November 17, 2015

@ 6:00 pm

Where

Neighborhood

Payment Center

6209 NW 18th

Ave

Miami, FL 33147

For

more info and pre-registration contact:

Nikita Ivory

305-635-2301

|

|

|

|

PASS IT ON! If

you know of others like family and friends that might benefit from this

program forward this to them.

City

of Miami Economic Initiatives

City

of Miami

|

Thursday, October 15, 2015

A Sex Scandal Rocks Stanford’s Business School (BusinessWeek)

Management problems at a shrine to management

Attendees mingle during the grand opening of the Knight Management Center at Stanford Graduate School of Business in 2011.

In April 2011, Stanford’s Graduate School of Business threw a party at its brand-new $345 million campus in Palo Alto. Thousands of students, alumni, and staff swayed to gospel singers and the Stanford band, sampled tofu banh mi on bamboo plates, and took cell phone-guided tours of the eight wood-and-glass buildings spread over a dozen palm tree-dotted acres.

The day’s keynote, “What it takes to get to the top,” featured a debate between two of the school’s best-known professors. Joel Peterson, who’s also chairman of JetBlue Airways, told a packed auditorium of 800 that trust and respect for others are essential in leadership; intimidation and manipulation always fail in the end. Jeffrey Pfeffer, who’s taught a popular class on power at the school for 36 years, said odds are you can’t be nice, honest, fair, and also successful; the path to power is paved with ruthless self-promotion.

Although begun under his predecessor (with a $105 million gift from Nike co-founder and alum Phil Knight), the new campus reflected the ambition of the school’s visionary dean, Garth Saloner. He’s transformed the school, known by its acronym, GSB, into a hub of management innovation worldwide. What the dean called an “inflection point” at the campus’s inauguration has proved true: The school trains executives in Bangalore, Beijing, London, New York, Santiago, and São Paulo. It steals top academics from rival Harvard, boasts the world’s lowest admission rate, 7 percent, and the highest median base salary for MBA graduates, $125,000 a year. Yet one of the nation’s top-ranked management schools is struggling with a management problem of its own.

GSB staffers describe an administration ruled by fear

On Sept. 14, Saloner, 60, shocked the Stanford community when he announced he was resigning his post at the end of the school year. (He will remain at Stanford as a tenured business professor.) A South African-born economist, he’s renowned for his work on how Internet network effects provided early entrants in a tech market with insurmountable advantages, and he was instrumental in persuading the U.S. Department of Justice to sue Microsoft for antitrust violations in the 1990s. He’s led a substantial overhaul of the school’s curriculum, emphasizing global studies and critical-thinking skills, and reeled in the GSB’s biggest gift ever, a $150 million grant to fight poverty by educating local entrepreneurs in places such as Ghana. His cryptic resignation flashed on students’ iPhones just as the first-years took part in a mandatory orientation session on the Stanford code of conduct.

Saloner’s statement said only that he didn’t want “a baseless and protracted lawsuit related to a contentious divorce between a current and former member of our faculty” to harm the school’s reputation. Later that day, an article published by Poets & Quants, a website that covers business schools, broke the news of a 17-month-old discrimination lawsuit against Saloner and the university. Filed by a former professor, James Phills, 55, the suit alleges that Saloner, a widower, conspired with the dean’s lover, Deborah Gruenfeld—Phills’s estranged wife and also a GSB professor—to push Phills out of his GSB job and kick him out of his campus home. The claims, pending in Santa Clara County Superior Court in San Jose, turn on whether Saloner, after informing Stanford Provost John Etchemendy of his relationship with Gruenfeld, 53, properly recused himself from any decisions regarding the separated couple. Also at issue is whether Etchemendy made sure Saloner took no part in decisions relating to Phills and Gruenfeld, in accordance with state law and school policy. The suit claims Phills, who is black, has suffered “a hostile workplace and ongoing retaliation by Saloner” and faced discrimination based on his marital status, race, and gender.

The suit has thrust the GSB’s personnel practices into public view. In a Facebook exchange between Gruenfeld and the dean in November 2012, shortly after they began seeing each other, Gruenfeld asked Saloner about Etchemendy’s reaction to learning of their romance. Phills, who got the messages by using his wife’s Facebook password, filed them as evidence in divorce-court proceedings. Judges in both cases have denied requests by Gruenfeld, Saloner, and Stanford to keep personal texts and e-mails private.

Gruenfeld: “So I guess we aren’t sneaking out tonight.

”Saloner: “How? Where?”

Gruenfeld: “Dunno. Just can’t let go of it. Oh—speaking of blow by blow—what did Etch say exactly?…

”Saloner: “He basically ignored what I said about the two of us and, not in these words, that he trusts me to make any decisions regarding Jim [Phills]. That is his style. It is almost as though he pretends he hasn’t heard, although of course he has. I think it is his way of saying, ‘you have done what the policy says you have to do, I appreciate it, but the policy wasn’t written with you/this in mind and so I’m respecting your privacy and ignoring it.’

”Gruenfeld: “Love that. So discreet and respectful.”Saloner: “He is a class act all around. He never ever disappoints me in the way he approaches things.

”Saloner and Stanford deny Phills’s allegations of discrimination and say they upheld all laws and university policies. Gruenfeld, Phills, and Etchemendy declined to comment for this article. Stanford, in a written statement, says Saloner properly recused himself from decision-making about the couple and that the university terminated Phills this year because he chose not to return from leave in favor of more lucrative employment at Apple. Phills was treated “fairly and equitably,” Stanford says, and the GSB, under Saloner, “continues to perform at exceptionally high levels.

”At the business school, reaction to Saloner’s resignation, and the love-hate triangle that engulfed him, is divided. Many faculty members are disappointed to see Saloner go. Since his appointment in 2009, he’s expanded the faculty by 15 tenured professors, to 124. Many like that he consolidated programs, tightening the purse strings in the dean’s office so he could free up money from the school’s $220 million annual budget for recruiting and research. “The prevailing mood is disappointment and dismay that we’re having a transition when we have so much momentum,” says finance professor Peter DeMarzo.

Saloner has fewer admirers among the school’s 440-person nonfaculty staff, the people who make the GSB run. To many of them, as well as a dozen or so bitter critics whom he fired or drove out over the years, the dean is the embodiment of Pfeffer’s cold-blooded theory. They describe an administration ruled by fear, with a dean who browbeats subordinates who challenge him, defunds programs that don’t fit his agenda, and drums out longtime managers on the thinnest of pretexts. These detractors exult at Saloner’s fall—at what Peterson described in the debate against Pfeffer as the inexorable self-destruction visited upon ruthless leaders. Says Sharon Hoffman, a former associate dean who ran the MBA program from 2001 until she was demoted and quit in 2012: “When Garth came in, it went from morning in America to Soviet Russia.”

Saloner, with jowly cheeks, frameless glasses, and a full head of graying brown hair, is the rare Silicon Valley stalwart who wears blue blazers and freshly ironed shirts. His voice still carries a faint South African ring from his Johannesburg childhood. Colleagues describe him as a fierce intellectual fighter and a reluctant listener. “Get your flak jacket on,” says Bethany Coates, a GSB assistant dean who’s worked for Saloner for six years and finds his combative manner highly effective.

Saloner earned an MBA at the University of the Witwatersrand in Johannesburg and his doctorate in economics at Stanford in 1982. He taught at MIT for eight years, then returned to the GSB in 1990 and never left. Saloner and his wife, Marlene, raised three daughters; all three attended Stanford, two earned MBAs there.

An expert on game theory and mathematical modeling, Saloner did some of the earliest work showing how the effects of computer networks can lock in customers. That’s because first movers often establish technical standards, such as operating-system software, to which consumers and developers become attached. Saloner’s ideas helped Netscape’s lawyer Gary Reback finally persuade federal prosecutors that Microsoft’s use of its clout in operating systems to tie computer makers to its browser software was unfair to competitors. Saloner, a charismatic lecturer with a knack for explaining arcane material, has won the GSB’s Distinguished Teaching Award twice, one of only two professors to do so.

Saloner talking with students in 2011.

Under Saloner, the GSB only grew in its role as a finishing school for billionaires in training. Every year dozens of MBA students, nurtured by professors and thousands of alumni in nearby tech companies and venture capital firms, start companies. Mary Barra, chief executive officer of General Motors, was in the class of 1990, and EBay’s first full-time employee, Jeffrey Skoll, got his Stanford MBA in 1995. Former Microsoft CEO Steve Ballmer dropped out of the GSB in 1980 to become the first business manager for his dropout friend from Harvard, Bill Gates.

In the inner sanctum, Saloner scares people, staff members say. A former program executive director, Kriss Deiglmeier, says he shouted her down at a meeting in front of more than a dozen colleagues, even after the budget at issue had been approved by his office. Shortly after his appointment, he fired Erica Richter, the director of alumni education, who’d recently recovered from cancer. She’d worked for the school for 14 years and was eligible for retirement in eight months. “I asked Garth if there were any other jobs I could do to keep my health insurance until I retired, and he said, ‘Nope, nope. I’m going in a different direction,’ ” Richter says. (A school official close to the dean but not authorized to speak by the school said Saloner didn’t know about Richter’s health at the time.)

Early on, Saloner pushed Sharon Hoffman, the director of the MBA program, to crack down on the GSB’s party culture. According to a former associate dean not authorized to speak by Stanford, drunken GSB students on a class trip to Las Vegas were led off a plane before takeoff. This person also says a pilot on another trip threatened to divert in the air if they didn’t settle down. “We became rules girls,” Hoffman says, nixing midweek ski trips and the rescheduling of exams to accommodate Ultimate Frisbee tournaments in Florida. After angry students lashed out at Saloner at a town hall meeting, he called Hoffman into his office and, she says, furiously accused the associate dean of setting him up. She’d warned Saloner’s top deputy what to expect, but he never told the boss for fear of angering him, Hoffman says. “ ‘You have a new charter for the year,’ ” Saloner told her later. “ ‘From now on we say yes to students!’ ”

In a written statement, Saloner said, “I’ve been very ambitious and passionate about advancing the mission of the school. ... I strongly believe in getting the whole team aligned behind a focused vision. I have to acknowledge that, although it was definitely not my intention, the process of achieving alignment was sometimes harder on people than I realized.”

Gruenfeld teaches an “Acting with Power” class.

Gruenfeld goes by Deb and has a wide smile and shoulder-length brown hair. A social psychologist with a doctorate from the University of Illinois, she’s one of the world’s leading experts on the psychology of power. She’s shown how it corrupts in unintended ways, emboldening people to act heedlessly on their desires. She teaches a course called “Acting with Power,” which uses theatrical techniques to help students “who have trouble ‘playing’ authoritative roles.”

Phills, a heavyweight wrestling champion at Harvard who competed into his 40s, has a soft, freckly face, the body of a linebacker, and the warmth of a teddy bear, friends say. He earned his Ph.D. from Harvard in organizational behavior and went on to teach at the Yale School of Management.

The two met at a conference in 1994. Phills was at Yale, and Gruenfeld was teaching at Northwestern’s Kellogg School of Management. They became a couple five years later. Gruenfeld avoided “marriage material” during the first 12 years of her academic career, worried a husband “would be the end of my independent thinking, my independent self,” she wrote in a 2011 e-mail to her life coach, while trying to save her marriage. The e-mail was filed as evidence in the divorce case.

Gruenfeld and Phills married in 1999. In the 2011 e-mails to her life coach, she wrote that her fears came true. “I backed away from work, fearing that my continued successes would intimidate him and he would be resentful. … I am lost; I have made Jim my God and he has nothing to offer.”

The couple moved to Stanford a year into their marriage and bought a house on campus with a low-interest loan from the university tied to Gruenfeld’s job. They had two daughters while there. A popular teacher and prolific writer, Gruenfeld was appointed to faculty committees that revamped the school’s curriculum and selected Saloner to be dean. She became friends with Facebook Chief Operating Officer Sheryl Sandberg and joined the Lean In board.

Phills, meanwhile, became a faculty director of the GSB’s Center for Social Innovation, which ran management training programs for government and nonprofit leaders. He was co-director of the center for a decade, co-founded and edited the field’s leading journal, and designed and taught six training courses. “Jim bridged the chasm for me between the social sector and business,” says Diane Solinger, head of employee social responsibility at Google, who took Phills’s executive-education course. “His training was one of the most formative things I’ve done in my career. I still use the framework with my team.”

The Center for Social Innovation attracted lots of students and alumni support, but Saloner thought the social-impact focus did not directly serve business students and faculty, says Deiglmeier, the center’s executive director from 2004 until last year, when she left to become CEO of Tides Foundation. In 2012, Saloner gutted the center’s budget, and Phills lost a big chunk of his teaching income when the center stopped doing executive training sessions. In May of that year, four months before Saloner and Gruenfeld started seeing each other, Phills took a leave from Stanford to teach management at Apple. The GSB restarted the training program later under a different professor, which Phills alleges was part of the Saloner-Gruenfeld conspiracy to keep him from returning.

Gruenfeld left Phills in June 2012. That same month, Saloner’s wife, Marlene, died after living with cancer for more than a decade. Two months later the dean, in an e-mail to Gruenfeld about one of her committee assignments, mentioned he was doing better and hadn’t forgotten about Gruenfeld’s suggestion for yoga. “Hope to be in (mental) shape to reach out soon,” Saloner signed off.

A few weeks later he asked her out for coffee, and they met for a walk. “Thanks for this morning. It felt really good spending that time with you,” the dean e-mailed afterward. After a few more dates, they drew closer—close enough, they agreed, that Saloner ought to tell the provost.

He e-mailed Etchemendy on Halloween morning. Saloner disclosed he’d seen Gruenfeld “a few times socially,” and though he wasn’t sure where the relationship was heading, he wanted the provost to know “out of abundance of caution.” Gruenfeld was on leave and didn’t have any pressing employment issues, but “Jim is a different matter.” Phills was due to decide soon whether to come back to Stanford full time. The negotiations would be handled by Saloner’s deputies. “It is possible that I will be asked to weigh in at some point, and at a minimum will certainly be asked to ratify their recommendations,” the dean said. “I propose to ask you to approve our thinking on whatever we decide (and perhaps to weigh in more substantively, depending on what we recommend).” The provost responded two hours later: “I am absolutely supportive of everything you decide with regards to Jim. I’d be very sorry to lose Deb.” In his deposition, Etchemendy said: “Remember, Jim has his appointment because we were recruiting Deb. So, you know, if we lost Jim, it would not have been a tragedy. Losing Deb, on the other hand, would be.”

Saloner and Gruenfeld kissed for the first time a few days later, according to Gruenfeld’s deposition. On Nov. 4 the GSB’s senior assistant dean notified Phills that, with Gruenfeld not living with him, Phills needed to repay about $750,000 that Stanford had lent the couple years earlier. “It would be cleanest if you jointly sold the house,” the assistant dean advised. Phills asked if he could get an exception to remain in the house with his daughters and elderly mother. The assistant dean, after conferring with Saloner, said no.

Phills claims he suffered “ongoing retaliation.”

Phills followed his wife’s deepening relationship with Saloner from the beginning, reading her e-mail and Facebook accounts with passwords he had acquired during their marriage. Gruenfeld knew he was spying on her, but her efforts to block him were unsuccessful. When she tried, he sent her taunting messages that said he could still see her communications, Gruenfeld said in a divorce-court filing. (She would later state in the filing that Phills “gave himself access to my devices by owning them, registering them in his name, buying special applications, and using iCloud.”) Saloner set up a new Facebook account to chat with Gruenfeld under the pseudonym Jeni Gee.

Phills blames the bitter turn in the divorce negotiations on Saloner, citing a Facebook chat on the eve of a key divorce negotiation. Gruenfeld: “Maybe he’s staying at Apple.

”Saloner: “Let’s hope. We deserve something good tomorrow. We’ve earned it.

…”Gruenfeld: “Sadly, deserving has not bought me much so far.

”Saloner: “The universe owes us. Big time.

”Gruenfeld: “I agree. Maybe we’re turning a corner on that.”

In another exchange on Facebook about the divorce negotiations, Saloner told Gruenfeld that “you and your advisers (therapist and lawyer) are approaching this too much as women (ouch!) You are being rational and generous.” He said Gruenfeld should express her anger at Phills to make her a less predictable and rational adversary. “He would pout, posture and do the elephant seal thing. But it would push him back like a right to the jaw.

”The divorce got nasty about four months after Gruenfeld and Saloner started dating, according to a court filing by Gruenfeld. When she was dropping off the kids in Phills’s driveway one afternoon, Phills came charging out of the house, insisting he needed to speak to her. Gruenfeld resisted, and he briefly held on to her car door to prevent her from leaving. That night, Saloner took her to file a report with the Stanford police. She obtained a temporary restraining order against Phills a few days later, claiming his online spying was terrorizing her and that he drank too much, owned guns, and posed a danger to Gruenfeld and their daughters. Phills denies the allegations. Nine months later the judge, based on an evaluator’s report, dismissed the order as unwarranted.

Saloner had other adversaries to contend with. When Deiglmeier and two other women left Stanford early last year, Phills threw them a goodbye party at his Stanford home. The margaritas, and the war stories, flowed. What emerged several weeks later was a letter to the provost endorsed by 46 current and former GSB employees, about half of whom still worked at the school. It complained of a “hostile work environment—especially to women and individuals over 40—ruled by personal agendas, favoritism and fear.” The letter urged the provost not to reappoint Saloner to a second five-year term, and noted his romance with a subordinate, who was married to another subordinate, set a “poor example” for students and was “stereotypical of the behavior of many discredited CEOs.

”Etchemendy met with representatives of the signatories in the spring of 2014 but told them he’d reappointed Saloner as dean, though it hadn’t been announced. Stanford hired outside lawyers to look into the letter’s claims. They found no evidence of discrimination but noted “a persistent underlying theme” of tension between GSB staff and the school’s leadership. The dean was perceived as “arrogant and disrespectful,” with questions “legitimately raised” about his fairness and communication style. Some comments in employee surveys from 2013 and 2014 were “consistent” with these complaints, they said. In a written statement, Stanford said the GSB has been addressing the investigators’ suggestions.

The dean got a new term in office. Phills got a lawyer and sued.

Gruenfeld and Saloner are still together. Phills’s discrimination suit is mired in the discovery phase, with both sides demanding documents and Stanford and Saloner trying desperately to preserve a modicum of privacy for the dean’s and Gruenfeld’s personal communications. The divorce, too, drags on. Gruenfeld is supervising Ph.D. students and teaching. Saloner has no plans to step down before spring. Phills still lives in the couple’s campus home, fighting Stanford over the loans. He teaches at Apple, where, thanks to stock options, he has quadrupled what he made at Stanford, earning more than $1 million a year for the past few years.

In a Facebook chat between Gruenfeld and the dean, Saloner imagined a climactic resolution to the cinematic version of their story, like the one in the 1976 Japanese-French film In the Realm of the Senses. It ends with the heroine severing the penis of her lover, whom she has just suffocated during frenzied sex. Saloner’s rewrite for Phills included just six words: “Knife. Penis. Town Square. Got it.” (Town Square is the outdoor commons area on the GSB’s campus.)

Gruenfeld demurred, suggesting her own vision of how their triangle should end. “I’m thinking more like you and I stroll off into the sunset looking gaga, and he has to live with a mountain of shame and regret.”

Faculty members are debating whether the Saloner affair will tarnish the GSB. Is this the inescapable takedown of a man and institution that lost their way, as Peterson would predict? Or is Pfeffer right, that power is won and sustained through baser instincts? Peterson declined to comment, except to say “all three people involved are terrific, and this makes me so sad.” Pfeffer says the GSB will bounce back; institutions are bigger than single individuals.

“The only difference between Stanford and Google is we have a higher profit margin,” says Pfeffer. “This school is a success story.”

Subscribe to:

Posts (Atom)