Trulia crunched income data to identify cities where mortgages will soon look more affordable.

Here’s a happy reminder if you're someone who finds escape by perusing real estate listings for unobtainable homes: A mortgage that strains your budget now will be a lighter burden a few years, and a couple of job promotions, down the line.

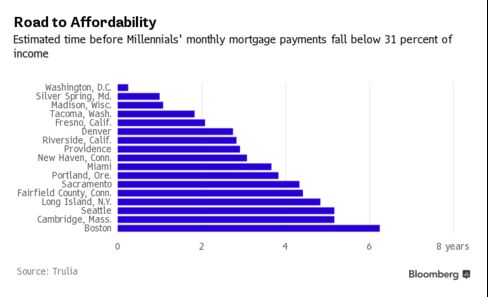

Young professionals willing to stretch their budgets now should consider Boston, Seattle, and Washington, D.C., among other cities, according to a new report from Trulia. In New Haven, Conn., the typical millennial (defined by Trulia as an adult between ages 25 and 34) can expect to spend 37 percent of her income on housing in the first year of her mortgage. Three years later, though, the same homebuyer’s monthly payments will fall below 31 percent of her income, according to Trulia’s estimates. By the last year of her 30-year mortgage, she’ll be spending 11 percent of her income on housing.

"There's a sweet spot of metros where a mortgage looks obtainable but unaffordable, but where it doesn't take long to become affordable," said Ralph McLaughlin, a housing economist at Trulia.

Trulia built its model on the rough assumption that in three decades, today’s 25-year-olds will earn the same as today’s 55-year-olds. (It also baked in some inflation.) That seems like a reasonable basis for comparing local housing markets, but an overly broad one for making financial decisions.

Here are some other caveats: It wasn’t very long ago that U.S. homebuyers helped wreck the world economy by stretching their budgets to buy homes they couldn’t afford. Don’t do that. And even if you want to, it will be harder to find an enabling mortgage lender this time around. The average debt-to-income ratio that a borrower needs to close a loan has hovered around 25 percent in recent years, according to mortgage software company Ellie Mae, indicating that many buyers would struggle to convince a lender to let them stretch.

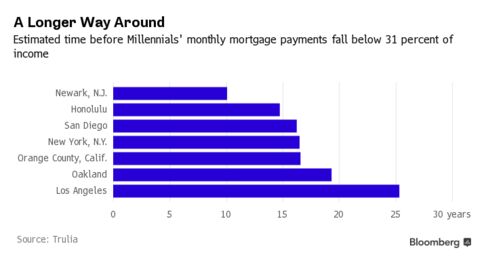

The other thing that stands out in the Trulia report is the low likelihood that young workers will ever be able to afford homes in California. In San Francisco, the typical millennial will still be spending 48 percent of her income on housing in the last year of her mortgage. In San Jose, the figure is 38 percent. In other words, the median home will still be unaffordable to the median millennial when that group is approaching retirement. It’s a grim picture up and down the coast.

California, to judge from the above, looks destined to become the land of the elderly.

No comments:

Post a Comment